What is depreciation? Starting off with the basics

Since the majority of a company's assets such as furniture, machines, or buildings lose in value over the course of their useful life, they can only be used for a limited time. Other intangible assets such as software, licenses, patents, or blueprints, and various current assets such as partially or fully finished goods or even company shares, may also suffer from market price decreases in the form of value diminishments as they become obsolete. To trace such losses in balance sheets, they must always be recorded by the company’s accounting department. All this is nowadays known as depreciation.

Depreciation is an indispensable part of accounting and tax law. However, the term often causes confusion among young entrepreneurs, who struggle not only to find the difference between straight-line and declining balance methods of depreciation, but also have difficulties in differentiating between assets which can and cannot be written off. Find the answers to these and many other question below.

What does depreciation mean? Defining the concept

The wear and tear of computers, office furniture, machines, cars, or even buildings in your everyday business activities is a natural process causing various decreases in value, which must be subsequently recorded in your accounts as depreciation. Such wear and tear is of great importance both in a commercial and fiscal sense.

Recording depreciation for commercial purposes is a matter of presenting company assets and their corresponding value diminishments in a correct manner by means of balance sheets and other similar financial statements. On the other hand, tax depreciation offers the possibility of reducing the amount of taxable income reported by a business. However, these two processes are not always connected.

Planned and unplanned depreciation

In principle, depreciation can either be planned and unplanned. The former, time-based method, is the result of scheduled, regular value diminishments, whereby the total value of an asset is divided by the estimated number of years of its useful life and depreciated in accordance with this calculation method. If an asset’s useful life is undeterminable (which is often the case with various licenses or other similar intangible acquisitions), it is generally scheduled for ten years.

Depreciation of company assets can be caused by factors such as:

- Natural wear and tear

- Expiry of rights or licenses

- External forces (meteorological, for instance)

- Technical progress

It is not only this scheduled depreciation calculation method, but also various unplanned depreciation types which pertain to current assets. If a machine endures unexpected, unrepairable damage or suffers a loss in its market value caused by changes in stock market shares, you can subtract respective depreciable amounts from the asset’s total value during any given financial year.

Which assets can be depreciated?

In principle, every loss in an asset’s value must be taken into account. It is, however, primarily a question of depreciation caused by wear and tear, or in other words, the natural deterioration of objects with a limited useful life, the purchase or production costs of which can be fully written off during this period. Tangibles such as office machinery, Persian carpets, or even entire factory sites and intangibles such as licenses, computer programs, or rights show just how wide the range of depreciable assets actually is.

Depreciation methods

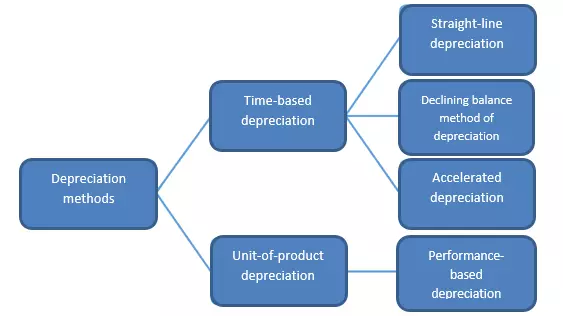

As we have already mentioned in this article, depreciation can either be planned or unplanned. However, planned depreciation entails further methods, which assign different calculation techniques to write off the value of assets. The amount you write off depends solely on the chosen method. Below are the most fundamental methods.

Time- and performance-based depreciation

Since each financial year must generally include depreciations on assets with limited useful life, the annual calculation of depreciation is the most common when assessing value diminishments of company assets.

In some cases, however, so-called unit-of-production depreciation is also a possible calculation technique. In this depreciation method, the asset’s value diminishment is calculated on the basis of its exploitation. A typical example of this is a truck, the value of which is assessed according to its mileage. This calculation method is therefore not based on the asset’s period of use, but rather on its overall performance (just like the truck has been assessed according to the distance it covered).

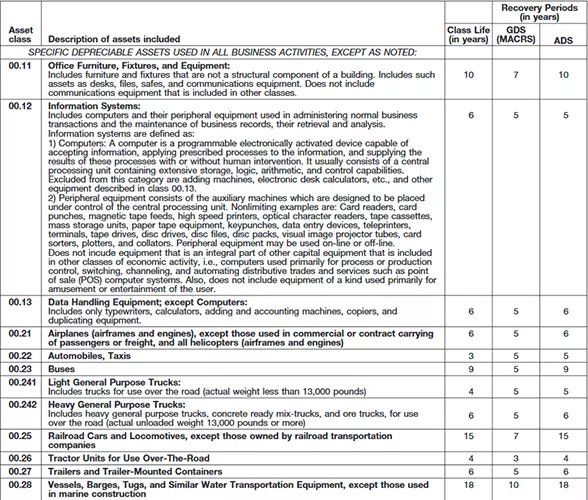

Depreciation rates – Table of Class Lives and Recovery Periods

In cases of time-based calculations, the amount of annual depreciation depends on the asset’s useful life. In order to correctly calculate depreciable values, and ensure that the amounts will be deemed accurate by the Internal Revenue Service (IRS), you will need to write off your asset values according to the depreciation rates found in the Table of Class Lives and Recovery Periods. This table specifies the useful life of all assets subject to depreciation under the general depreciation system provided in section 168(a) of the United States Internal Revenue Code (IRC). You are more likely to fulfill all fiscal requirements if you follow the guidelines found in this document.

Below, we present a sample extract from the table:

Straight-line depreciation

Straight-line depreciation is the most common of all time-based depreciation methods. Here, the asset’s carrying value is evenly spread over its entire recovery period. What this assumes is that the asset is exploited at the same rate during each of its recovery period years.

In other words, the depreciable amount remains the same for each year of the asset’s useful life apart from the acquisition year, during which the asset’s value diminishment is assessed on the basis of the month in which it was obtained (for instance, if the asset was purchased in April, then the first three months are not taken into consideration when calculating the depreciation value).

Declining balance method of depreciation and accelerated depreciation

As the term “accelerated depreciation” may already suggest, when using this calculation technique, the annual depreciation amounts increase during each of the asset’s recovery period years. However, this depreciation method is rarely used, as it is traditionally only suited for facilities, which generate greater income year after year (wineries).

The declining balance method of depreciation is closely related to this. In this method, the amounts that you subtract from the asset’s value are continuously reduced over the course of its recovery period. Annual depreciation values therefore start at a higher level and then gradually decrease. This method, primarily aiming to promote investment, was temporarily approved for this very purpose during the global financial crisis of 2008.

The declining balance method of depreciation, which sets a fixed depreciation rate (20%, for instance) on the respective book value, follows a geometric depreciation sequence in the process of calculation. In addition to this, there is also an arithmetic depreciation sequence, in which the book value, as its name suggests, is determined using a declining numerical sequence.

Claiming deductions on investments

The current tax depreciation system of the United States – MACRS (Modified Accelerated Cost Recovery System) – consists of two depreciation systems: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS), which provide different methods and recovery periods when calculating depreciation deductions, one of them concerning tax-deducible investment expenses. These are mostly related to business assets. The amount of deductions on investments depend on the type of asset.

Low-value assets

Not all company assets cost several thousand dollars. Items, which have been acquired or produced for smaller amounts are considered low-value or low-cost assets. Classic examples are coffee machines, mobile phones, or even individual office furniture.

The IRC states that, as a depreciation deduction, there should be a reasonable allowance for the wear and tear of property used in a trade or business. Although it does not define the allowable value of low-value assets, the de minimis safe harbor election gives taxpayers the opportunity to depreciate according to the following thresholds:

- Deduct amounts up to $5,000 for those who have an applicable financial statement, or

- up to $2,500 for those who do not have an applicable financial statement on the total amount paid to acquire, produce, or improve tangible property, provided certain requirements are met.

Summary: what does depreciation mean?

- What is a depreciation? Depreciation records the loss of value of individual assets, i.e. the amount by which individual assets have been reduced

- The current tax depreciation system in the United States is regulated by MACRS (Modified Accelerated Cost Recovery System) by the United States Internal Revenue System (IRS)

- There are two basic depreciation types: planned and unplanned depreciation

- The most common depreciation methods are time- and performance-based

- Special rules apply to low-value assets

- The Table of Class Lives and Recovery Periods is a depreciation table providing information on the recognized useful lives of assets

Click here for important legal disclaimers.