Single entry accounting – an introduction

For many businesses, accounting can be a real pain in the neck, and ideally something which could be avoided. However that does not reduce the importance of accounting, and it is something that every business needs to do; big or small. Given that bookkeeping is such a vast and expansive subject, there are of course bound to be several different types. One of these is single entry accounting. This article will aim to tell you what this type of bookkeeping is, who should be doing it, as well as what the difference is between it and its counterpart, double entry bookkeeping.

What does single entry bookkeeping entail?

According to the IRS (Internal Revenue Service), the single entry system records the flow of income and expenses through 1) a daily summary of cash receipts and 2) monthly summaries of cash receipts and disbursements. It can be made up of transactions taken from a notebook, daybook, or journal. It can also include an entire set of journals and a ledger containing accounts for all important entries. Such entries can be sourced from a business checkbook, a depreciation schedule, employee wages record, and ledgers showing debtor and creditor balances. Primarily however single entry bookkeeping only really involves transactions that a company has with external parties. Any transactions or financial dealings that might take place internally within a business – such transactions can be of great importance. In general, it is a firm’s income statement around which its single entry bookkeeping system is based.

Single entry accounting takes place primarily in the form of a cash book, i.e. a record of cash-based income and expenditure which has space above and below to show both the balance at the start and at the end. As this is quite a simplistic way of doing accounts, it means that single entry bookkeeping is mainly done manually because all computerized systems use the double entry system. This is also the case with the majority of accounting software available to entrepreneurs and businesses.

Who can use single entry bookkeeping?

The idea behind single entry accounting is to make calculating profit easier for small businesses. The lower the turnover, the less need there is for the complexities that come with double entry bookkeeping. Therefore it is the simplicity that makes single entry bookkeeping so appealing.

The simple nature of single entry accounting is then reflected in the type of businesses that utilize it. For entrepreneurs running a solo operation, chances are that the single entry system will be sufficient for them and their accounting needs. This system is also much easier to learn and thus will not require the acquisition of expert assistance. It becomes especially relevant then for newly founded companies, who are unlikely to have enough resources to launch a comprehensive bookkeeping system. As the firm evolves then, it is extremely likely that they will need to adopt the double entry system. It is only really the case that a company can continue to use single entry accounting if the scale of the business remains small and its transactions remain relatively basic.

Disadvantages of single entry accounting

While there are several positives that come with using the single entry system, it also has its fair share of downsides too. Due to the fact that it does not contain all information relating to the business, management will not have full access to data that is necessary for running a company. This leads to an administrative process that is not as accurate as it could be and therefore reduces the control that one might have over the day to day running of the business.

With single entry bookkeeping it is the case that assets and liabilities are usually recorded but only with a single entry for each. This means that theft and other losses are less likely to be detected. In fact it is the case that one person, i.e. the one in charge of the accounts, could single handedly cook the books and misappropriate the company’s financial resources.

Thus the above circumstances mean that it is impossible to compile a comprehensive overview of a company’s financial condition. This affects not just current managers and investors, but also potential future investors as well, as a financial statement prepared via single entry accounting processes are not a viable indicator for overall business performance.

Whereas the double entry accounting system requires that each entry matches, this is not the case with the case with the single entry system, making it much more prone to accounting errors. As might be expected then this also means that auditing is not possible with single entry bookkeeping.

Singe entry accounting – an example

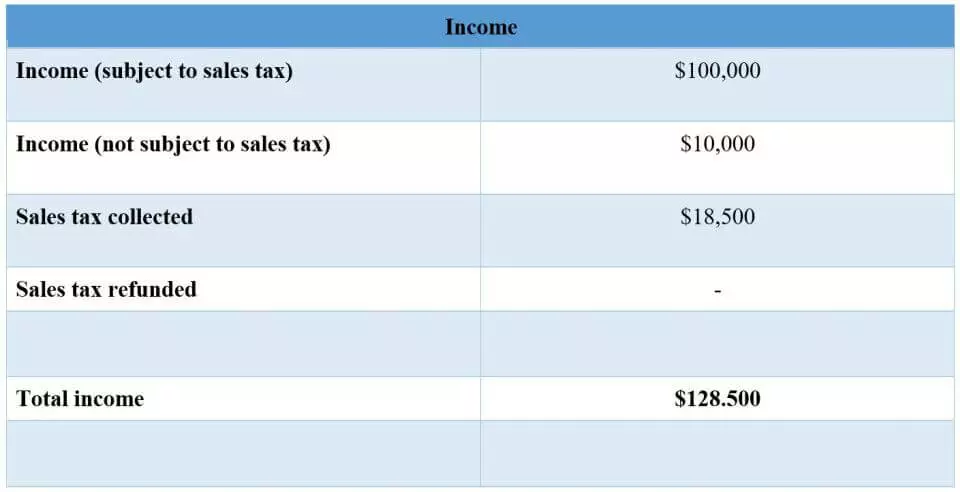

With single entry accounting it is sufficient for you to basically just make a list of all business incomes and expenses for the period in question. For example, it can look as simple as this:

Only the income and expenditure that actually took place in the period in question are considered, i.e. the so-called cash method of accounting. Like with double entry accounting, income/expenditure via a third party, inventory changes, accruals, etc. are taken into consideration with single entry bookkeeping.

Single entry accounting – the pros and cons

| Pros | Cons | |

|---|---|---|

| Simplicity | More prone to errors | |

| Less expensive | Easy to manipulate | |

| Easier to understand | Not an effective performance indicator | |

| Cannot be audited | ||

| Crucial information not always included | ||

| Internal transactions not included |

In 1494, the Italian mathematician Luca Pacioli published a book wherein was the first published description of the double entry bookkeeping system. This has not meant that the last 500 there has been no use for the single entry approach to bookkeeping. As we have seen above, there are certain aspects of single entry accounting that could appeal to businesses, especially those of a smaller kind. However as we have also seen, there are many limitations to this accounting approach. In general though, single entry accounting is a system of bookkeeping that companies use out of necessity as opposed to one that they may find the most desirable.

Click here for important legal information.