Writing sales receipts with correct templates

Creating sales receipts belongs to the canon of standard business practices, just as with writing invoices. Issuing a sales receipt can be a lot easier than issuing an invoice and with the correct template, it’s like child’s play. But what needs to be considered when creating a sales receipt and why do they have to be created in the first place? In this article, we will explain how to correctly issue a receipt and which obligatory details you shouldn’t forget.

What is a sales receipt and what is required?

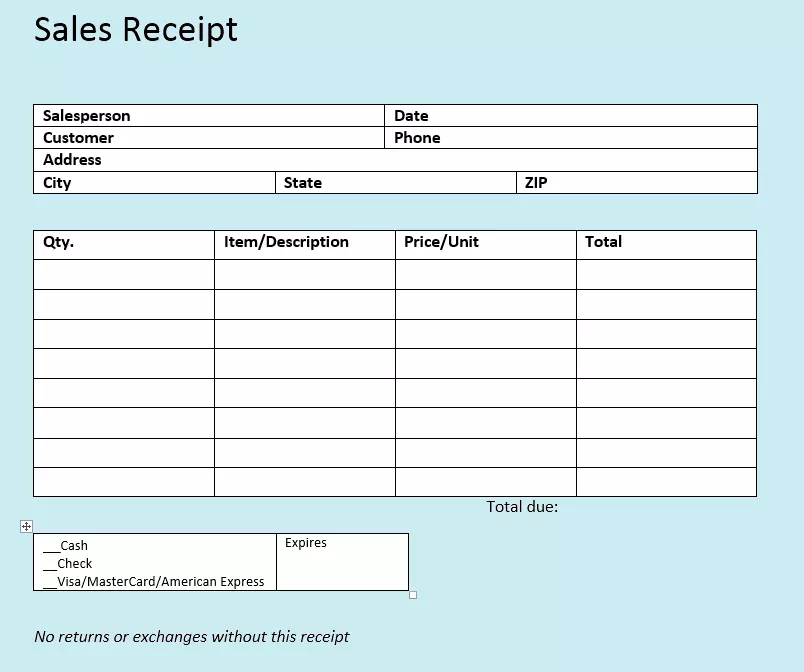

A sales receipt is an acknowledgment confirming the payment for a service or a product. The document typically shows the date and time that the purchase was made, the items purchased, the amount, the method of payment and the store details if the item was purchased from a brick and mortar store as opposed to over the internet. By law, the electronic receipts issued by vendors must comply with the regulations in the location that the sales receipt was issued i.e. where the vendor is located. The regulations of the FDIC (Federal Deposit Insurance Corporation) must be adhered to and in many cases, this means that the vendor has to indicate the card or bank used on the sales receipt as well as the transaction date and the authorization number. The signatures of both the vendor and the customer need to be present as well as a description of the products, a description of the transaction type, and the amount of tax paid. If the customer used a different currency then the conversion needs to be shown.

What is the difference between a sales receipt and an invoice?

An invoice is a request for payment. It is generally a list of the products ordered or the services obtained and also features prices, credits, discounts, taxes, and the total amount. Many invoices state when the customer has to pay by (usually around 30 days), and whether there’s a discount if they are able to settle the bill earlier. You will most often find information related to the business such as the address, telephone number, fax number, and website address provided on an invoice.

A sales receipt shows that payment has been made and that a sale has been finalized. It can act as proof of ownership should something go awry. They are similar to invoices in that they include the goods or services, prices, credits, discounts, taxes, the total amount paid, and the method of payment. There’s also the vendor’s contact information, but not much customer information since this acts as a receipt i.e. the customer’s proof of purchase.

How to create the sales receipt

You can design the sales receipt by hand e.g. using a receipt book or by using a digital sales receipt template on your PC. Special accounting programs can make your work much easier. With professional software, you have the possibility of connecting the task of creating sales receipts with your whole accounting. This not only saves you the processing work, but all the required data is automatically transferred to your sales receipt simultaneously. This saves time and reduces the risk of errors. Depending on the number of receipts you need to write daily, a digital solution may be worthwhile.

Click here for important legal disclaimers.