What are overhead costs and how to calculate them?

With the help of overhead costs, you allocate indirect costs that cannot be directly assigned to a specific cost unit to individual cost units. By adding the overhead costs to the direct costs, you calculate the total costs for a product or service.

- Free Wildcard SSL for safer data transfers

- Free private registration for more privacy

- Free 2 GB email account

What are overhead costs?

The cost of a product or service is made up of direct and overhead costs, with both having a direct effect on the resulting price. Since direct costs can be assigned to individual cost drivers (which stands in stark contrast to overhead costs), they are easily determinable. However, to cover overhead costs, it is advised to include them in the cost of individual products or services and to take them into account when determining their final value.

In general, there are two types of overheads – either cost center or those related to cost drivers. Examples of the latter type include costs for rental, depreciation, as well as training- vehicle-, building-, energy-, advertising-, or telephone and internet-related costs. On the other hand, cost center overheads relate to branches, business departments, and product groups. Overhead costs can be generally split into four separate categories:

- Material overheads (e.g. warehouse rental, salaries of workers from the purchase department, from the incoming goods warehouse, as well as those inspecting the goods)

- Production overheads (e.g. factory rental, natural wear and tear of machinery)

- Sales overheads (e.g. sales and marketing department salaries)

- Administrative overheads (e.g. HR and accounting department salaries, office supplies)

How to determine overhead costs

Overhead costs refer to the percentage added to direct costs, enabling the allocation of overhead costs to cost units. The overhead cost rate can be determined for each type of cost center using a cost accounting sheet or allocation table.

Before determining the overhead cost rate and allocating it to individual cost units, distribute the overhead costs to the various cost centers. Allocation is based on the cause-and-effect principle. Cost centers refer to specific business areas, often corresponding to the departments or functional units within a company. This allows you to track which costs were incurred in which business areas. These costs can then be broken down further and assigned to individual products. To distribute the overhead costs to cost centers in the first step, you first need to know the total sum of the overhead costs.

How to allocate overhead costs to cost centers

Using an Operating Cost Allocation Sheet (OCAS), you can distribute overhead costs across various cost centers. The operating cost allocation sheet is a tool used in cost accounting. In a table, different types of overhead costs and their respective amounts in dollars are assigned to the relevant cost centers. For an accurate allocation of overhead costs, it is important to use a cause-oriented distribution key. In the following example, the overhead cost types (salaries, rent, and insurance) are allocated using the following common distribution keys:

- Employee salaries according to their respective cost centers

- Rental costs according to the surface used (sq. m.) of respective cost centers

- Employee insurance costs according to their respective cost center

Calculating overhead costs

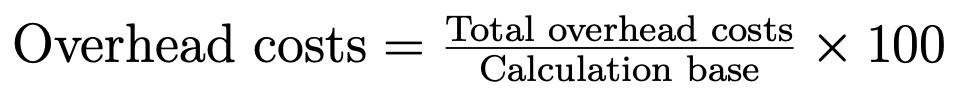

The following formula is used to calculate the overhead cost rate:

The overhead cost rate formula can be understood as follows: divide the total overhead costs by the calculation base. The calculation base typically refers to the respective direct costs (e.g., material costs) of the corresponding cost center. Finally, multiply by 100 to obtain the percentage rate.

Allocating overhead costs to cost units

Once the overhead cost rate has been determined, the overhead costs can be allocated to individual cost units. To do this, simply add the overhead costs to the direct costs.

Cost-plus pricing

Cost-plus pricing is necessary when a company manufactures various goods at different costs. The cost difference can then be traced back to materials and various manufacturing processes. With this form of calculation, you can decide between plantwide overhead and departmental overhead rates.

Plantwide overhead rate: In this case, the total amount of overhead costs is settled with one overhead rate, which is determined by dividing the former by the total direct costs amount from a given financial period. However, the main disadvantage of this method lies in the fact that there is an unchanging ratio between overhead costs and different direct cost types.

Departmental overhead rate: Using the multiple overhead rate means that each production department may have its own predetermined overhead rate. With overhead and direct costs in mind, such departments can be materials-, production-, administration- and sales-based. It is by means of this method that the overhead rate was calculated in the example above. Labor hours and machine hours are commonly used in many factories.

How to calculate overhead costs with an example

To better understand entries in a cost allocation sheet, let’s illustrate this with an example for the material cost center: There are 8 employees working in the purchasing department, incoming goods warehouse, and incoming goods inspection. These departments belong to the material cost center. Each employee earns a monthly salary of $2,500, resulting in overhead costs of $20,000. The monthly insurance cost per employee in this cost center is $500, adding up to overhead costs of $4,000 for insurance. Additionally, warehouse rental costs amount to $6,000, representing the overhead costs for rent.

| Overhead Cost Type | Material |

|---|---|

| Salaries | $20,000 |

| Rent | $6,000 |

| Insurance | $4,000 |

| Total Overhead Costs | $30,000 |

| Direct Costs | $100,000 |

| Overhead Rate | 30% |

Calculating overhead costs example

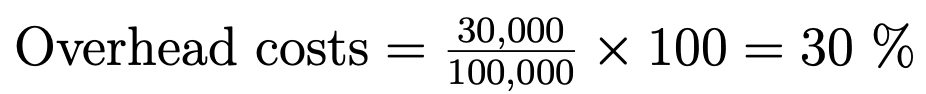

Using our example, the overhead cost rate for material overheads can be calculated by dividing the total overhead costs of $30,000 by the direct costs of $100,000 and then multiplying by 100. This results in an overhead cost rate of 30%.

Allocating to cost units

In the given example, the direct costs for material overheads are derived from the total value of purchased and processed materials. For instance, if the material costs for a product or service are $1, they are subject to an overhead surcharge of 30%. This results in total costs of $1.30.

Once you have determined the overhead costs using the rate, you can calculate the total price of a product or service by adding the direct costs to the overhead costs. The contribution margin indicates how much a product contributes to the company’s overall profitability.

Reach out in your name every time you hit send — includes domain, 2 GB+ storage, and more.

Please note: This article includes a legal disclaimer.