Debit and credit

The term “debit and credit” is generally associated with money, business, and commerce. You will also find the two words in your personal finances: Do you have a “debit” bank account? Do you have additional money available in it? As a business owner, you need to reconsider: You come across debit and credit as the core concept of proper, “double-entry” bookkeeping. But the two words have a more formal meaning here – “credit” is by no means the same thing as “having” something. What exactly is debit and credit? These terms are explained below.

- Free Wildcard SSL for safer data transfers

- Free private registration for more privacy

- Free 2 GB email account

What is debit and credit? A definition

The words debit and credit are taken from accounts, or more precisely, from double entry accounts, as they are used in the principles of proper accounting. These principles consist of legal regulations and informal rules and are intended to ensure that the accounts “provide an expert third party with an overview of the business transactions and the situation of the company within a reasonable period of time.” The business transactions must be accountable on both sides of the transaction. This means that accounting records the business transactions of an enterprise in numerical values – and according to the principles of proper accounting, this should take place in a timely and factual manner and the transactions must be traceable, with documentation.

The third parties mentioned in the law are all those who might have a legitimate interest in the business transactions of the respective company. These include, for example, the shareholders of the company, under certain circumstances (e.g. in the event of insolvency) also the business partners, and the state – usually represented by the tax office.

In commercial accounting, debit and credit refer to the left or right side of an account in which a certain value to be processed is recorded.

Double-entry bookkeeping

For orderly accounting i.e. financial accounting, the system of double-entry bookkeeping is used worldwide today. Historically, double-entry bookkeeping was first used in northern Italy in the first half of the 15th century – and in principle it has changed very little to this day.

Why “double entry”?

The term “double-entry accounting” derives from the fact that this accounting method affects two separate accounts, as an account has two pages, a debit and credit side.

However, the concept of debit and credit also means that there are (in principle) no negative values in double-entry bookkeeping – unlike on the account statement of your bank account, for example. Only positive amounts are posted – either left (debit) or right (credit).

The opposite sides of the two accounts are always balanced. This results from the standard form of a record: it is always valid and is “debit to credit.” A posting can also address several accounts on one side or the other. Of course, the amount on the two sides must be the same.

A second interpretation is based on the two books of which this bookkeeping essentially consists: The journal (or register) records business transactions in chronological order. The general ledger contains the accounts to which these transactions are recorded.

A third explanation of the term “double-entry bookkeeping” indicates that there are two ways to measure a company’s success – through:

- The balance sheet, showing whether the company’s assets have increased or decreased compared to the previous year

- The profit and loss account, which shows the profit or loss for the period, when expenses are subtracted from income/revenue

The balance sheet as the basis

The basis of any double-entry accounting is a single account: the balance sheet. It provides an overview of the financial situation of a company: on the left are the assets, on the right: liabilities and equity (which represents the amount of money that would be returned to a company’s shareholders if all of the assets were liquidated and all of the company's debt was paid off). One can say: On the left is what the funds of a company are used for, and on the right is where they come from. However, the left and right sides of the balance sheet are not called debit and credit, but asset and liabilities.

There are guidelines for how to break down a balance sheet. The assets on the left are, among other things:

- Intangible assets – licenses, business value, goodwill

- Property, plant and equipment – land and buildings, as well as technical equipment and machinery

- Financial assets – e.g. investments in other companies

- Current assets – raw materials, consumables and supplies, as well as work in progress and finished goods

- Receivables – e.g. from sales/services rendered

The liabilities on the right include:

- Shares, reserves, and net income (or loss) for the year

- Provisions for future obligations

- Liabilities – bank loans, bonds, trade payables, and other liabilities

The shares, reserves and net income for the year form the company’s equity. All liabilities that will have to be paid off in the foreseeable future, or will bear interest – i.e. credits, bonds, outstanding invoices, but also provisions – are summarized under the term debt capital.

Accounting in periods

As the balance sheet item net income (or deficit) already indicates, another important accounting principle is applied in a company’s balance sheet: time period assumption. At regular intervals (financial years), a company must “draw up a balance sheet” – i.e. an opening balance sheet at the beginning of the period and a closing balance sheet at the end. The course of the financial year in question is then determined by comparing these two balance sheets.

Accounts and subaccounts

All financial balances are reflected in its balance sheet. Theoretically, you could also post all business transactions to this one account. In practice, however, this is completely impracticable, and the SEC’s demand for clarity and comprehensibility of accounting would not be met. Therefore, each operating account works with a chart of accounts – that is, a whole system of accounts and sub-accounts, but they are all derived from the balance sheet.

Depending on the field of activity of the individual company, these charts of accounts can look very different. For the different types of companies and branches of industry, however, there are so-called charts of accounts that can be adapted individually and thus make the accounting department’s work easier.

Balance sheet accounts and profit and loss accounts

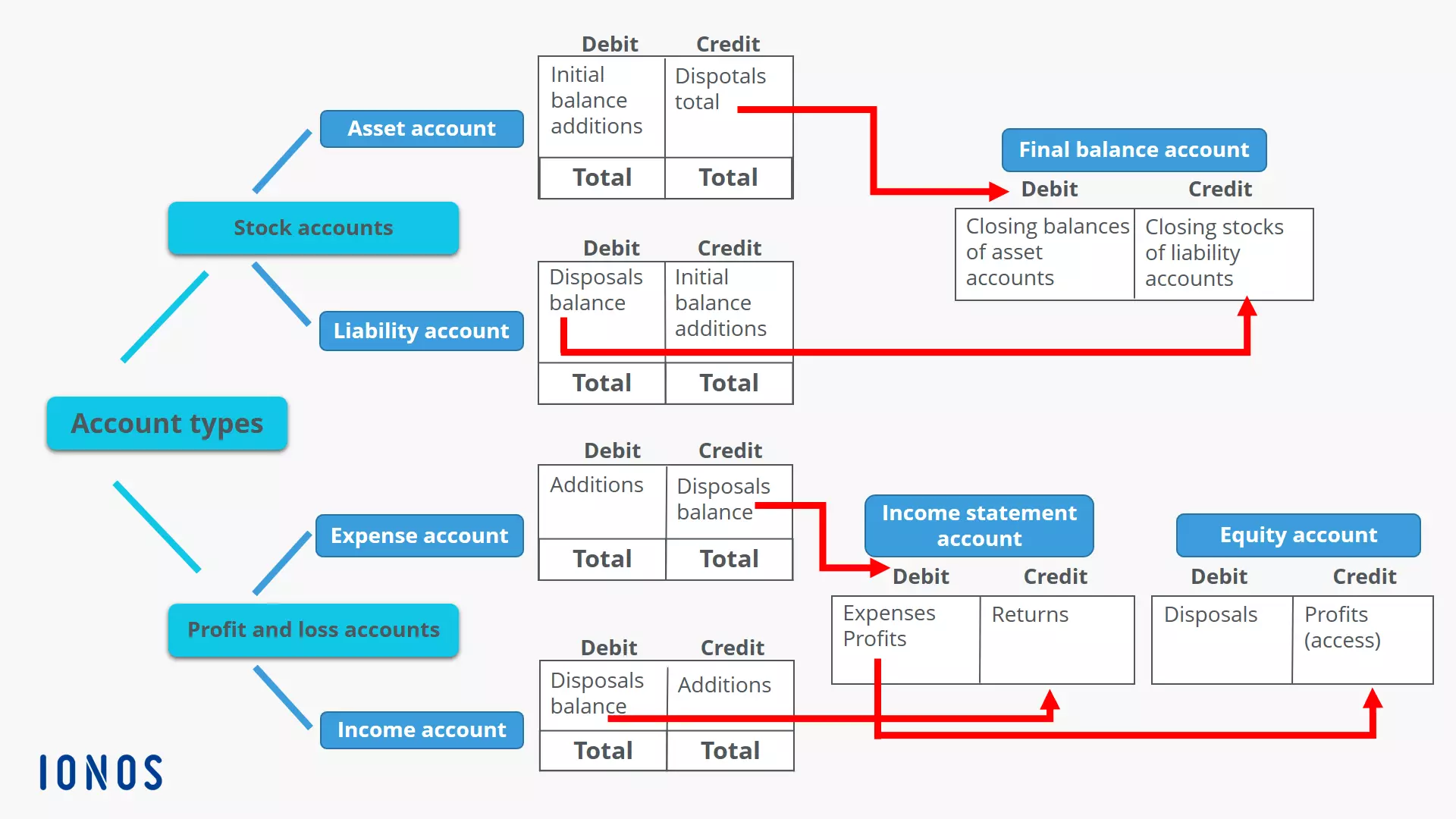

There are two main classes of accounts, which are derived from the balance sheet as subaccounts and subdivided as required: balance sheet accounts and profit and loss accounts.

The inventory accounts, as their name suggests, concern the raw materials, work in progress, and finished goods of a company. The asset accounts contain the tangible assets, inventories, cash and cash equivalents, and so on that are located on the asset side of the balance sheet. The liability accounts comprise the equity (business shares, reserves, annual surplus, etc.) as well as the borrowed capital (loans, outstanding invoices, and other liabilities) on the liabilities side of the balance sheet.

The equity capital of a company occupies a special position: The profit and loss accounts in accounting are sub-accounts from this balance sheet area – again divided into income accounts and expense accounts. These are mainly sales revenues – but asset growth is also included. In the expense accounts, you post expenses that reduce the company’s assets – for purchases, rent, interest, as well as wages and salaries.

Powerful Exchange email and the latest versions of your favorite Office apps on any device — get started with our free setup assistance.

Business transactions not affecting income

There are also business processes that have no influence on the success of a company – they are neutral in terms of financial performance. When posting such transactions, no profit and loss accounts are involved, only balance sheet accounts.

For example, when a customer pays an invoice, the amount of money in the supplier’s bank account increases and the receivables decrease accordingly. As a result, nothing changes. Other examples are the purchase of a new machine or raw material for production. Depending on whether the goods are paid for immediately or later, the cash balances on the assets side of the balance sheet decrease or the liabilities on the liabilities side increase. However, the increase in assets due to the purchased goods compensates for this in each case. The expenses that influence the profit total for the businesses are also included in the profit and loss account here, like depreciation of the machine.

On the annual accounts: balancing the accounts

A further principle rounds off double-entry bookkeeping: All accounts must be balanced at the end – in other words, they must show the same totals in debit and credit. This applies first of all to the balance sheet itself. It must always be prepared in such a way that the totals on both sides are the same.

However, all other accounting accounts must also be balanced. To do this, you post a balance at the end of the year that clears the two sides of an account to the next higher account, and repeat this until you finally arrive at a special balance sheet account in which all the balances are collected. The actual balance sheet is then formed from this account.

The closing of all accounts, which forms an essential part of the annual financial reporting process, ensures that all the values posted to the various accounting accounts during the financial year find their way to the balance sheet at the end of the year.

Debit to credit: post business transactions correctly

Ultimately, every business transaction changes the financial situation of a company in some way. Accordingly, these events must be documented. And that is exactly what bookkeeping is for. Typical examples of business transactions are:

- A company purchases goods on credit

- A company sells goods to customers who pay by bank transfer

- A company transfers salaries to its employees

- A company buys a new machine, pays part of the purchase price immediately in cash and the rest later on the payment date of the invoice

When to book on the debit side and when to book on the credit side?

The debit to credit bookkeeping applies to all records. But which accounts post a business transaction on the debit side and which on the credit side? Unfortunately, there is no general answer to this question. Depending on the type of account, receipts and issues are posted either on the one side or on the other. The rule is:

| Account type | Debit posting | Credit postings |

|---|---|---|

| Assets account | Additions | Additions |

| Liability account | Disposals | Disposals |

| Income account | Additions | Additions |

| Expense account | Disposals | Disposals |

Create posting records

The posting record with debits and credits provides information on which accounts are affected by a business transaction and whether the posting is made on the debit or credit side of the respective account. This means that the relevant amount is entered on the debit side of one account and then on the credit side of another account. An example: If a posting record is “Bank to cash: $100,” then the amount of 100 dollars is entered on the debit side of the account “Bank” and on the credit side of the account “Cash.” Both are current asset accounts, the bank increases by 100 dollars, the cash decreases accordingly: 100 dollars were withdrawn from the cash reserve and paid into the bank account.

Effective through profit or loss and not affecting profit or loss

Recognized in profit or loss are income and expenses that affect the assets of a company through the income statement. Income accounts are liabilities and expense accounts are assets. Typical income postings are:

- Cash at sales: $500 – goods were sold for cash

- Trade accounts receivable: $1,500 – goods were delivered on invoice with payment terms

Expense postings are corresponding:

- Rent to bank: $1,200 – the monthly rent was transferred

- Material consumption of inventories: $2,000 – raw material was used for production

Postings that do not affect net income, on the other hand, only affect a company’s inventories and do not change its asset situation (they are also called postings that affect inventory). Typical examples of this are:

- Inventory of liabilities: $1,000 – goods have been purchased and are to be paid at the end of the payment period

- Technical equipment at checkout: $5,000 and liabilities $10,000 – a machine was bought and partly paid for, partly financed with a trade credit

A business transaction in accounting

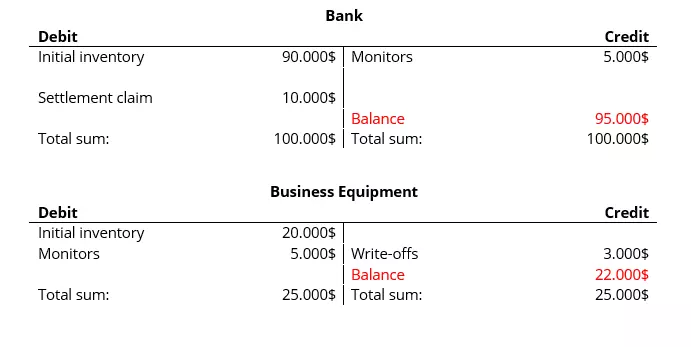

Here, you can see how business transactions are reflected in the books using a (very simplified) example. The transaction in question is as follows: You have purchased new monitors worth $5,000 for your office and paid with your bankcard.

The immediately paid purchase of the monitors can now be booked in the simplest case directly as an increase in the value of the business equipment against the reduction of the bank balance: office equipment at the bank: $5,000. (In practice, however, the gross amount paid would be divided into the net amount as an increase in the value of the office equipment and the input tax to be refunded by the tax office as a receivable and booked accordingly.)

To close the accounts

In our simple example, no further postings are to be made in the two accounts “Bank” and “Office equipment” by the end of the financial year. Then, in a final step, you calculate the balance, i.e. the difference between debit and credit, and clear the accounts with it.

A posting is represented graphically by so-called T-accounts. The name is derived from the letter “T”, which the table display of the accounts reminds you of.

At the end of a financial year, you must close all balance sheet and profit and loss accounts in your accounting department in this way. You post the balances to general ledger accounts and then to the closing balance sheet account, which serves as the basis for the statutory closing balance sheet. Always observe the golden rule of accounting: debit the receiver, credit the giver. The closing balance sheet is a statutory part of the annual financial statements. Your balances are transferred to the next fiscal year as opening balances.

The profit and loss accounts show the profit or loss

The profit and loss accounts are combined in the profit and loss account, which is a direct indicator of a company’s financial performance, for the purpose of their financial statements. This account is part of the company’s equity as retained earnings.

The following overview shows you the different account types. It also allows you to see what is posted on the debit and credit sides of an account. The arrows represent the accounting balancing process graphically.

The balance sheet accounts are debited from the closing balance sheet account. To do this, you post the balance of the asset account (credit side) on the debit side of the closing balance sheet account and the balance of the liability account (debit side) on the credit side of the closing balance sheet account.

Account balancing also takes place for profit and loss accounts according to the principle of posting the balance of the opposite side of the account, that is, debit to credit. The profit and loss accounts are closed. Postings are made here in the same way as for balance sheet accounts. The balance of the profit and loss can then be posted to an equity account. Finally, the profit (or loss) for the fiscal year can be seen from this account – if necessary, taking into account further changes in equity.

In our article on closing profit and loss accounts we explain the basic principles of the income statement and close the profit and loss account using an example.

Summary

The two pages of a double-entry account are called debit and credit. This accounting procedure, which is used worldwide, makes it possible to present the business transactions and the financial situation of a company clearly and accurately. Always follow the basic rules of double-entry accounting when making entries and closing accounts:

- Debit denotes the left and credit the right side of an account

- Debit what comes in, credit what goes out

Click here for important legal disclaimers.

- All your favorite Google productivity tools

- Business Gmail for your domain

- Using Gmail with your domain from IONOS