Cost estimates: Samples and recommendations for companies

Contractors, car mechanics and insurance agents hear on a daily basis: “Can I get a cost estimate for that, please?” This usually means extra work which doesn’t always bear fruit – the customer still might end up ordering from a competitor. But can you really blame them?

In the free market, it is a part of being a savvy consumer to first obtain several offers from different suppliers and compare them with each other before making a final purchase decision. The cost estimate is a welcome orientation aid for this; offering it willingly creates transparency for the customer and strengthens their trust in the company – an advertising effect that should not be underestimated. What should you consider when writing a cost estimate?

What should you keep in mind when preparing a cost estimate?

If your company is active in technical, financial or medical fields and offers a wide range of higher priced services, the first question about a cost estimate will be quick. Instead of being taken by surprise, you should have already made some preliminary considerations and get an appropriate cost estimate sample. It will be necessary to consider some facts.

Reminder: A cost estimate is an expert estimate of the costs to be incurred when implementing an order.

Additional expenses and remuneration

Preparing a cost estimate is a time-consuming and labor-intensive additional effort, which you may want to be remunerated for. However, beware: Customers like to see the cost estimate as a self-evident basic service and may feel deterred by a fee. This makes sense for your financial liquidity, because sometimes a cost estimate goes hand-in-hand with elaborate planning or extensive calculations. If it also represents an essential part of the actual service (e.g. troubleshooting prior to repairing a laptop), you have a strong argument on your side that justifies charging a free in any case. However, you must be sure to explicitly negotiate these fees with your customer and record any agreements. Charging a fee can also offer you an element of security against fraud: Customers who do not really intend to order a service from you are unlikely to proceed beyond the initial fee request.

In order to not scare off potential customers with your demand for compensation, consider pointing out in advance that this is a “nominal fee” that can be refunded when an order is placed or offset against the order value.

As you cannot prevent potential customers from making a price comparison anyway, you can also offer a cost estimate as a concrete service. To do this, you simply issue cost overviews that are structured in such a way that they can be presented directly to other providers. This makes it more likely that you, as an industry expert, will be the customer’s first point of contact. At the same time, you have the chance to submit your own offer.

Validity period

There is no general rule for the performance period, i.e. the period within which a cost estimate is valid. However, you should always specify a specific date, since it is possible that a customer will not come back to you unless costs for a particular component have just risen. When setting the deadline, also take non-financial factors into account, like seasonal differences or bottlenecks in the supply chain on public holidays. In any case, the period should be rather short; lawyers recommend a maximum of six weeks.

Legally binding

In contrast to concrete fixed price offers, cost estimates are generally non-binding, even if they are part of a contractual agreement, invoiced and signed by the customer. You as a business owner, do not assume any liability for the accuracy of the information in the cost estimate. This means that if the actual costs are higher than expected due to unforeseeable events (e.g. delayed deliveries or price increases), the estimated costs may be exceeded to a certain extent.

However, not every customer is aware of this circumstance, which is why you should explicitly point this out to them – include a sentence such as “this cost estimate is non-binding” should be enough. This not only creates mutual trust, but also covers you in the event of a dispute. Alternatively, you can limit yourself to giving approximate figures in the cost overview – amounts exact to the cent are rather unusual for cost estimates anyway.

Writing a cost estimate: What belongs in it?

As the customer expects a detailed list of all costs to be incurred, including the basis for calculation, sufficient time and care can and should be reflected in your cost estimate. The goal is a realistic estimate that is presented in a clear, complete and accurate manner. This includes the corresponding information:

- Type and scope of work

- Work time

- Labor costs (employee wages)

- Required material and corresponding material costs

- Possible expenses, delivery costs, other costs

- Validity period of the quotation

Depending on the service and the amount of work involved, it is also advisable to provide your customer with several different options and optional services that they can add to or detract from the cost estimate (this is common for insurance packages, for example). This gives them the opportunity to better tailor the job and the associated costs to their needs and budget – and may be more inclined to use your services rather than those of the competition. In addition, by placing your company name, logo and contact details prominently on the quote, the customer can immediately associate them with a price comparison and will have all the important information available right in front of their eyes.

If you are a small business, you may not need to include sales tax in the estimate.

Adapt the cost estimate to suit your needs

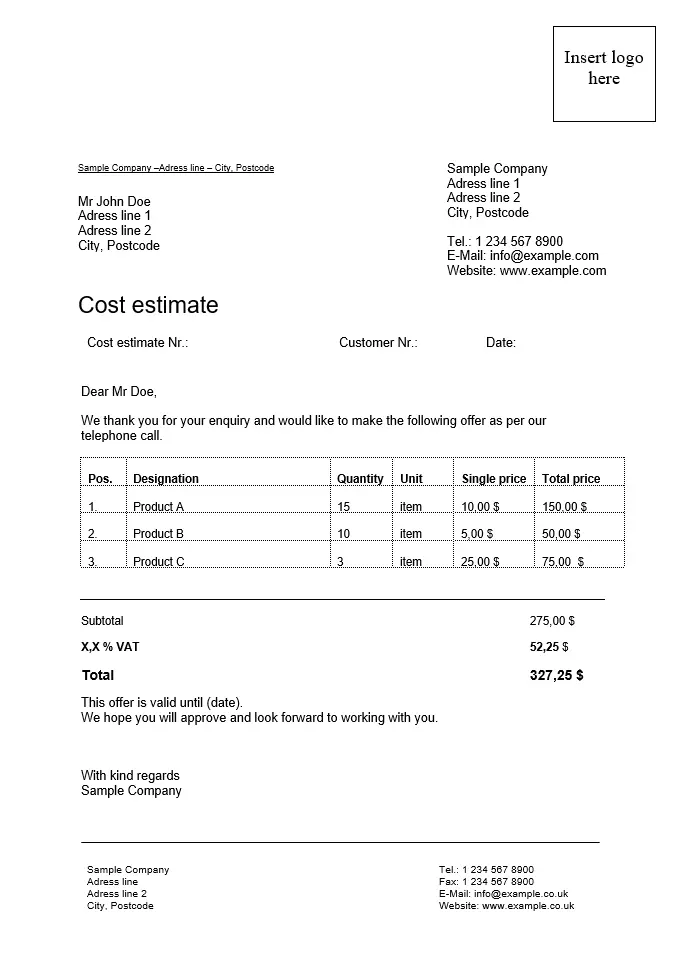

The following template shows a sample cost estimate in Microsoft Word for a fictitious company:

You can download this and a version for Microsoft Excel free of charge (see download section). While many users find Word easier to use, Excel provides some practical spreadsheet features, such as formulas for automatically calculating the total price of your quote.

The cost estimate templates offered are formatted and contain all the relevant components that you just need to adapt and add your own data to. To ensure that you don’t make any mistakes when entering numerical values, we have provided the corresponding places with “XX,XX” values (other cost estimate templates may include example figures here).

In any case, you should check your finished cost estimate very carefully again to avoid later disputes (e.g. about missed decimal places). Then save it as a Word or Excel file so that you can edit it again later. If you want to send the document to a customer, you should convert the format to PDF instead, or print it out on paper – then nothing can be changed later.

You can find out how to adapt the cost estimate templates to your individual needs in our step-by-step instructions.

- You can replace the template logo and the company address with your own address at the top of the template.

- Enter the recipient’s contact information below.

- To the right of it, you assign your customer a unique estimate number and complete the name and contact details of the contact representative assigned to them.

- Then comes the current date.

- In the subject line, repeat the customer’s individual cost estimate number.

- The initial text only needs to provide a polite, professional short introduction. At this point, you can indicate that this is a non-binding estimate (or place this note at the end of the document).

- In the following table, list all positions numbered consecutively. Start with the product or service with the highest price, so that the customer can immediately identify the biggest cost item. Also mention relevant details like quantities and unit prices.

- In the next row of the table, enter the total price. Since this is not an invoice, you do not have to list the sales tax. This is nevertheless recommended for private customers (if sales tax is applicable in your State).

- Under the table you can add some text, as well as your signature.

- Don’t forget to include your full company details, bank information, your sales tax ID number and the names of the managing directors in the footer.

- Up to 50 GB Exchange email account

- Outlook Web App and collaboration tools

- Expert support & setup service

To make sure that your business documents are completely legally compliant, the best course of action may be to use a professional accounting tool.

Click here for important legal disclaimers.