What is contribution margin and how to calculate?

The contribution margin is defined as the difference between a company’s revenue and its variable costs. This metric helps determine which products are economically viable.

What is the contribution margin?

The contribution margin is the difference between a company’s revenue and its variable costs. It represents the amount of revenue that is available to cover fixed costs. The contribution margin can be calculated for a product, a product group, or the total sales volume. This metric shows how much of the revenue contributes to covering fixed costs. For a company to generate profit from its regular operations, the total contribution margin must exceed its fixed costs.

Why do we calculate the contribution margin?

The contribution margin gives meaningful results when it stands in relation to other values. If you compare the contribution margin to the fixed costs, you obtain information on whether the company is making profits or losses. The relationship between the contribution margin and a company’s customer base may also be relevant in identifying clients that are particularly valuable to the company.

- The contribution margin is greater than the fixed costs: the company is making a profit in the standard business operations, as the receipts exceed the expenses.

- The contribution margin is the same as fixed costs: the result in the standard business operations has reached the point where it is balanced (break-even point).

- The contribution margin is lower than the fixed costs: the company is making a loss in the standard business operations, as the expenses exceed the receipts.

You can improve the result by reducing the variable costs for the use of raw materials or in the production process, by increasing the revenue with sales efforts, for example, or also lower the fixed costs.

How to calculate the contribution margin

You differentiate between the unit and total contribution margin. The calculation of the values is carried out using the relevant contribution margin formula.

Unit contribution margin: The difference between the unit price and the variable unit costs yields the unit contribution margin. This value indicates how much a product or a service contributes to covering fixed costs per unit.

Total contribution margin: By multiplying the unit contribution margin by the amount of sales, you arrive at the total contribution margin. With the help of the total contribution margin, you can identify how much the product or services have made in total (within a specific period).

How is the contribution margin calculated?

To identify the unit contribution margin and the total contribution margin, you can use single-stage or multi-stage contribution margin calculations. The relative contribution margin also enables you to identify an optimized production program.

The result of the single-stage contribution margin calculation provides information about the profitability of the company overall and is therefore of interest for general corporate decision-making in particular. With the multi-stage contribution margin calculation however, you can investigate the profitability of individual products, groups of products or areas of business, and make significant differentiated predictions for this.

Single-stage contribution margin calculation

With the single-stage contribution margin calculation, you obtain the operating result by deducting the total fixed costs from the total contribution margin. There is no differentiation of the fixed costs, as in the single-stage contribution margin calculation these are not regarded as being influenceable in the period under consideration. The operating result is synonymous with the economic success of the company unit being considered, i.e. with its profit or loss.

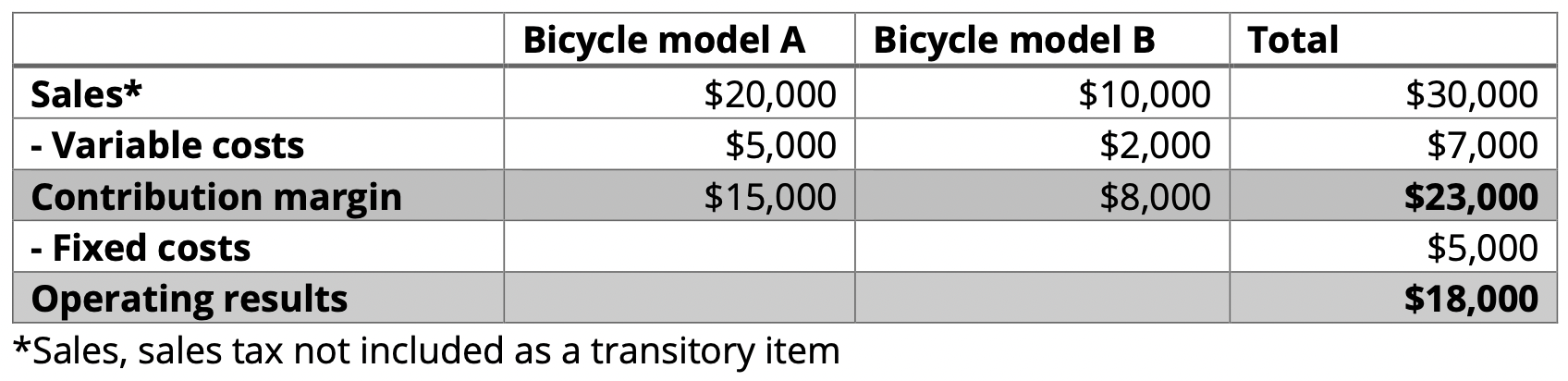

Example 1 – single-stage contribution margin calculation:

- You calculate the contribution margin for each individual partial revenue (here: bicycle models) by subtracting the variable costs from the sales proceeds in question. Bicycle model A achieves sales of $20,000 and has variable costs of $5,000. The contribution margin is therefore $15,000.

- Add the individual contribution margins together to obtain the total contribution margin.

- Then deduct the total fixed costs from the total contribution margin to determine the operating result. In the example, the total contribution margin comes to $23,000. Taking into account the fixed costs of $5,000, you come to the operating result of $18,000.

Multi-stage contribution margin calculation

In contrast to the single-stage one, the multi-stage margin calculation considers the fixed costs at several stages separately from one another, a differentiation which may assume a variety of forms. In example 2, there should be a differentiation of fixed costs that can be assigned to the individual product, the associated company department and the overall company. The aim of the multi-stage contribution margin calculation is to allocate profitability to the specific reference objects as far as possible, according to the costs-by-cause principle and with transparency.

- Product-specific fixed costs: the costs can be allocated precisely to a product or service (depreciations for a machine that is used to produce bicycle model A for example).

- Fixed costs by department: the costs can be allocated to a company department (e.g. for the workshop for bicycle production).

- Company fixed costs: these are general fixed costs that cannot be allocated to a product or a department (e.g. management salaries).

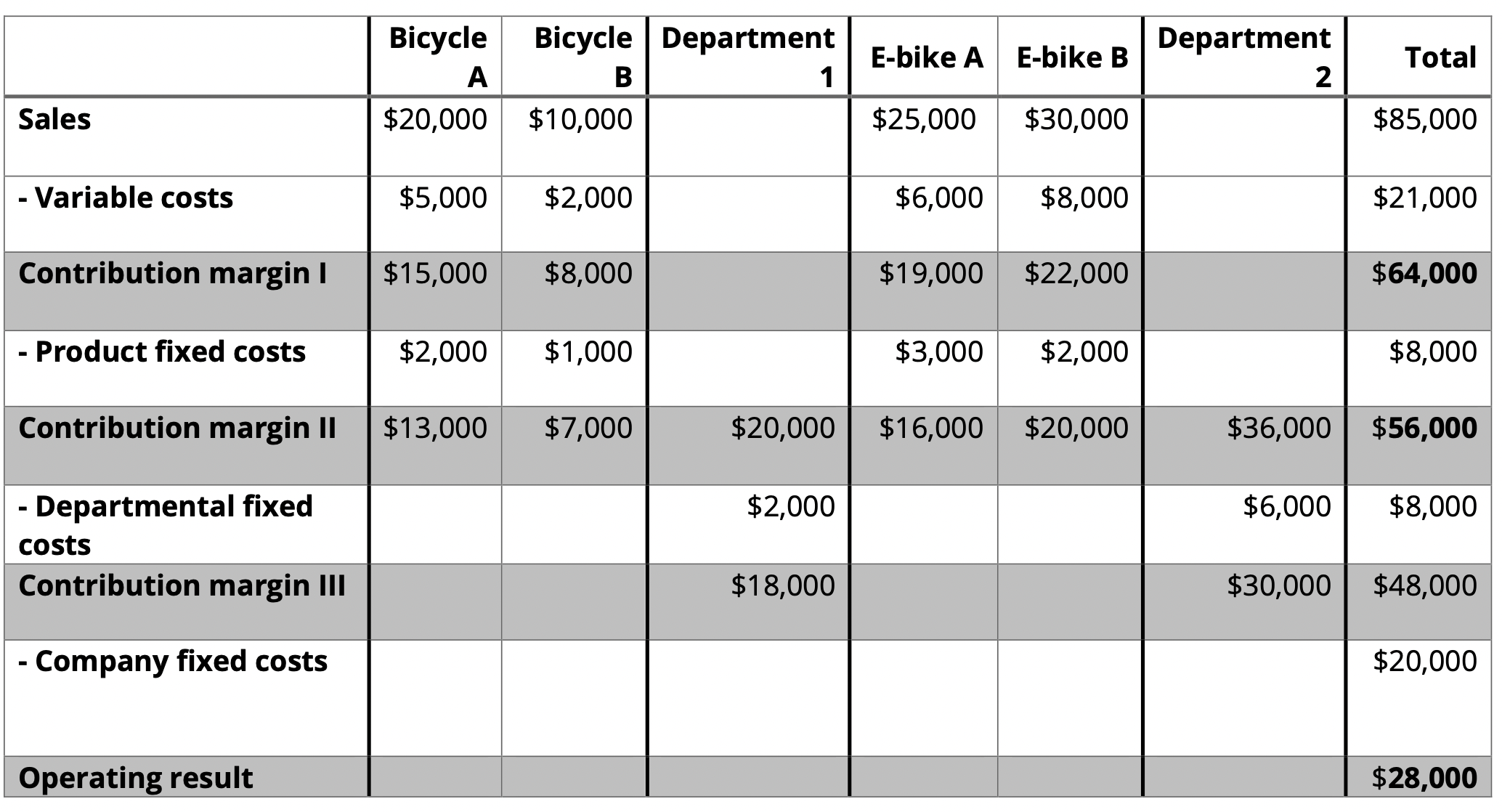

Example 2 – multi-stage contribution margin calculation:

-

In the same way as for the single-stage contribution margin calculation, in the first stage you determine the contribution margin for each individual product and add the individual contributions (four in our example) to contribution margin I.

-

If you have identified the product-specific contribution margin, you then deduct the associated fixed costs for each product and you obtain contribution margin II for the product. The total of contribution margin II for each product from a department gives contribution margin II for this department, and the total of these amounts in turn gives contribution margin II for the overall operations.

-

You subtract the departmental fixed costs from contribution margin II for the department in each case, to obtain contribution margin III for each department.

-

Now put together the totals for contribution margin III in each case and you obtain contribution margin III for overall operations. To find the operating result, the final stage is to subtract the company fixed costs from this contribution margin III.

What is the relative contribution margin?

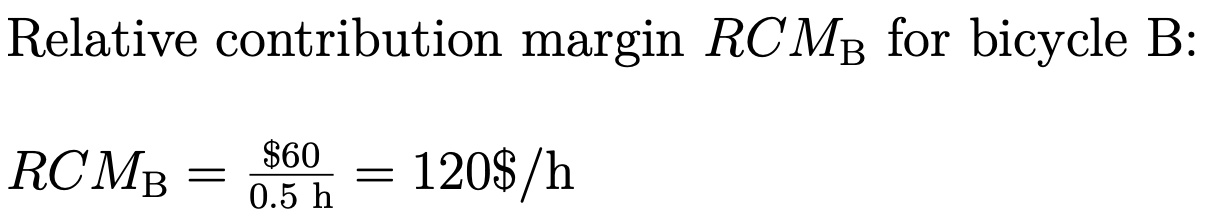

The relative contribution margin compares the unit contribution margin to the bottleneck factor, such as the capacity of a production machine or an employee. It helps optimize production planning when resources are limited, ensuring that available capacity is allocated to the most profitable products or services. The goal is to maximize the contribution margin of the constrained resource by prioritizing items with the highest profitability per unit of bottleneck capacity. The relative contribution margin is calculated using the following formula:

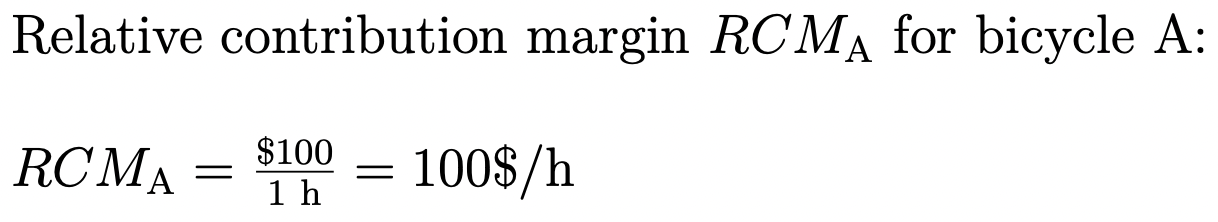

Example: The unit contribution margin for bicycle model A is $100. A certain machine is required for an hour for production. On the other hand, for bicycle model B, a production time of only 30 minutes with the same machine is necessary, so that the unit contribution margin is $60.

If the machine actually represents the bottleneck in the production and sales of bicycles, so if all other production and sales stations have a higher capacity, then bicycle B has a higher contribution margin than bicycle A and should therefore have production priority.

In practice, the comparisons are not that simple of course. In our example, twice as many bicycles of type B than type A would have to be produced for the calculation to be correct. However, the demand for B bicycles would not be sufficient to use the machine to capacity. The bottleneck would consequently no longer be the machine but the sales of bicycles of type B. Then the theoretically higher contribution margin would not be achieved in reality.

Please note the legal disclaimer for this article.