Cash pooling: liquidity bundling within a company

Everything in one place – this is one way of describing cash pooling. In this special form of group financial management, one group company’s credit balance is used to offset the negative balance of another. This offers a number of economic advantages, but it is also associated with potential taxes and company law risks. You should be aware of these if you want to set up and operate a cash pooling system.

What is cash pooling? A definition

Cash pooling, also known as liquidity bundling, is a special form of liquidity management. It is mainly used in groups in which several companies are organized under the management of a controlling company. Although the individual companies are legally independent, since the group as a whole acts as a strategic unit, mutual financial support and distribution of liquidity among the individual companies is in the interests of all parties involved.

As the companies in a group are organized independently of each other, their financial situation may well differ. This also has an impact on their liquidity or liquidity requirements (i.e. cash and cash equivalents). While one company finances itself with loans at market interest rates, another may have financial investments that are less profitable. To remedy this imbalance, a cash pooling system can be set up. This is usually run by a central financial management team organized by the parent company.

Cash pooling is a technique used to balance funds within a group of companies. The term consists of the words “cash” for money and “pooling” for merger.

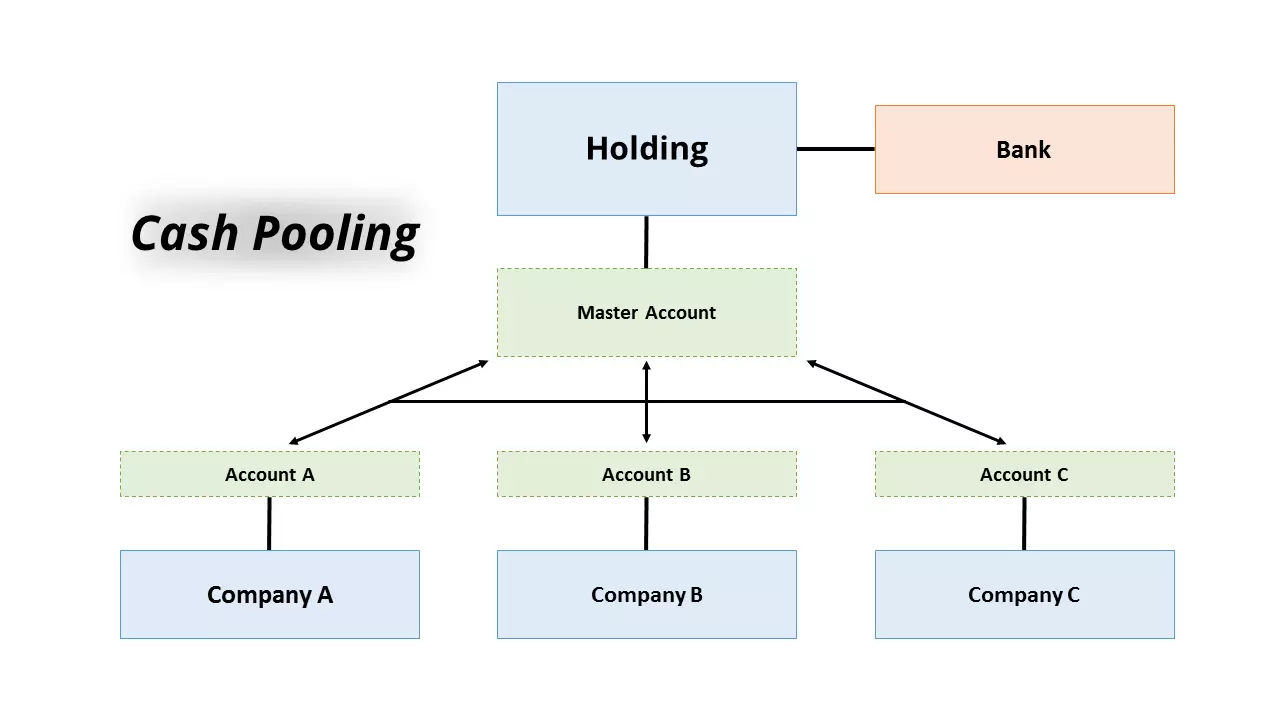

The parent company acts as a “cash pool leader” – or it assigns this task to one of its group companies. This cash pool leader then withdraws excess liquidity from the participating companies and collects it (for example, for investments) on a “master account.” The money is then used to cover the financial requirements of group companies with low-interest loans in order to prevent higher borrowing rates, or, in extreme cases, insolvencies. Receivables and payables are exclusively settled internally: The companies paying in the money have a repayment claim (without notice in an emergency) against the master account, while the borrower has a repayment obligation.

Advantages and disadvantages of cash pooling

The main advantage of cash pooling is that the capital available throughout the group is better used and the need for borrowed capital is reduced. External funds are only used if the group’s internal liquidity balance is insufficient to cover capital requirements. In addition, costs can also be saved in the procurement of capital (loans, bonds, etc.). As a rule, a top management group can negotiate better conditions than an individual group company. In addition, procurement costs are reduced if just one unit has to deal with them. Central cash management also has the advantage for group management that it provides a direct insight into the liquidity of the individual group companies. This makes it easier to predict financial crises and plan appropriate counter measures.

However, this is also the biggest disadvantage of cash pooling: Since the cash pool leader handles liquidity management centrally, the group companies lose economic independence. This is particularly detrimental to the more solvent pool participants. On the other hand, financially weak companies may rely too much on the cash pooling system and neglect their own liquidity planning.

Liability risk is another disadvantage of cash pooling: If a group company encounters problems and runs into financial difficulties, this has a direct impact on the group as a whole via the cash pool. It is therefore very important to maintain an effective management and early warning system linked to the cash pooling system.

| Pros and cons of cash pooling | |

| Advantages and chances | Disadvantages and risks |

|

|

Genuine and fake cash pools

In practice, cash pools can actually (“physically”) or only virtually be set up and operated. In the first case, the cash pool leader really has a master account to which one group company pays in excess funds and from which the other draws liquidity. On the other hand, it is also possible to leave the funds where they are and only allow them to flow virtually between the companies and the master account (known as notional pooling). In this case, the debit and credit interest of the individual companies is still calculated on the master account. This works because the banks are prepared, after consultation, to grant their loans to the individual companies at conditions that they would grant to the central cash pool leader.

However, this model is more complicated from a billing point of view than real cash pooling. The fake variant offers a particular advantage in this respect: Since there is no real cash flow, there are no real receivables or liabilities that could be legally questionable under certain circumstances (see below). Internationally active companies in the eurozone sometimes also use hybrid cash pooling. With a mixture of the two models, the real variant is used within the eurozone and the fake cash pooling is used in exchanges with companies in other currency areas. On the one hand, this avoids the expense of the otherwise necessary currency conversions, like hedging transactions. On the other hand, there are sometimes considerable legal hurdles to overcome for genuine cash pooling across national borders.

Legal aspects of cash pooling

Cash pooling and its pitfalls

For a long time, central liquidity management in corporations did not have a good reputation when it came to the law – especially for reasons concerning capital maintenance in corporations. Under certain circumstances, even corporation shareholders could be held liable in an emergency. Another problem can arise if companies in a group borrow money from each other, this can be interpreted as a hidden distribution of profits under excessively favorable conditions, with corresponding tax consequences. These favorable conditions could be an unusually low interest rate or a credit security waiver.

More problems could arise with regards to company law: Under certain circumstances, a capital contribution by the cash pool leader as shareholder of a group company can be interpreted as a hidden contribution in kind. This applies if a company loan is repaid to the cash pool. This means that if this group company were to go bankrupt, the cash pool leader as a shareholder would have to pay the contribution again.

If, on the other hand, the group company’s balance on the master account is balanced or positive, this can be a so-called back and forth payment, if a contribution paid in by the cash pool leader as shareholder of a group company subsequently lands on the master account as liquidity contribution. Even then, the contribution is deemed not to have been made because the group company does not have the money itself, but only a claim against the cash pool.

The situation can be aggravated by these problems if a company doesn’t document its cash pooling activities sufficiently or not at all. The competent authorities or courts may conclude from this that tax and/or company law rules were deliberately circumvented.

Cross-border cash pooling

The legal situation when it comes to cross-border cash pooling (also known as multi-currency pooling) is even more complex, i.e. when companies domiciled abroad participate with their respective national currencies. As there are no worldwide legal compliance standards, the cash-pooling laws of individual states involved must be taken into account when setting up a system like this. Cash pooling is also prohibited in many countries with restrictive financial systems, such as India. So, funds from a local company cannot simply flow into a master account (this is referred to as “trapped cash”).

Basic rules for cash pooling

In order to avoid tax issues or legal consequences, experts recommend observing some basic rules and civil law limitations. It is important to adhere to the arm’s length principal when designing a cash pool. There are no prescribed transfer prices for receivables and payables in internal liquidity balancing. However, the regulations adopted by the group must stand up to an arm’s length comparison. This means that financial investments and loans must be offered within the framework of normal market conditions – as would be the case for independent companies. In case of doubt, the bank interest rate agreed for the master account should be used as a guideline.

Compliance with the arm’s length principle is important when designing the cash pool. Although there are no prescribed transfer prices for receivables and payables in the internal liquidity equalization system, there is no such thing as an arm’s length principle in the design of the cash pool. However, the regulations adopted by the group must stand up to arm’s length comparison. This means that financial investments and loans must be offered within the framework of normal market conditions – as would be the case for independent companies. In case of doubt, the bank interest rates agreed for the master account should be used as a guideline.

A cash pooling system should also be transparent. This includes regular reports from top management and the right for all group companies to be able to see who is lending and receiving money at any time. In order to meet these requirements, appropriate information and exit mechanisms should be established. This is the only way for participants to be able to react to changes in the group’s liquidity situation, and, if necessary, cancel a loan that has been granted. In addition, it must be ensured that the cash pooling system benefits the group units or at least does not represent any disadvantages for them (through the permanent withdrawal of liquidity or default risks outsourced to them).

Last but not least, the group has a strict documentation obligation towards the tax authorities. This means that it must be able to demonstrate and justify the appropriateness of its transfer prices at all times. If this is not done, there may be a threat of legal consequences.

To be on the safe side when it comes to tax documentation, you should consult an expert tax advisor, a cash pooling bank or a specialist service provider.

How cash pooling works in practice

Setting up a cash pooling system may require some effort, depending on how many companies are involved and whether foreign companies are included. A thorough preparation phase is recommended, the first step of which is an analysis of the group: What are its structures, which companies are suitable as participants, and what are their legal framework conditions (especially for foreign companies)? Prior to implementation, the group units can be informed in workshops about the structure and functioning of the planned cash pooling system. Of particular interest are the leading and trailing edges for those involved as well as liability issues. Security is provided by a written contract, which should cover the following contents, among others:

- Conditions and credit limits

- Mutual loan granting

- Rights and obligations of use

- Arrangements for loan repayment

- Information rights

- Notice

- Admission of new participants

- Special rights of the cash pool leader

A characteristic feature of a balanced contract negotiation is that no party is overburdened, as otherwise the liability limitation is threatened.

You can download samples of cash pooling contracts from the internet.

Important: the cost structures

You should then gain an overview of the subsidiaries account structures. A bank that offers cash pooling is responsible for the actual processing of payments. The costs incurred play a central role in this, as the solution should be cheaper than the conventional banking transactions of the individual companies. Technical questions concern the file format for transactions (e.g. XML) and the times when the bank does not process payments.

To limit dependence on a single service provider, it may be advantageous to keep two master accounts at different banks. In addition, each currency should have its own master account (unless a hybrid cash pooling system is chosen).

Zero balancing or target balancing

It is now necessary to choose a suitable transaction model. With zero balancing, the associated accounts are set to zero at the affiliated companies on workdays or in some other regular manner and the balances are transferred to the master account. In contrast, target balancing only balances liquidity up to a previously agreed base amount.

Cash pooling in practice: an example

A group consists of a holding company and three companies. Their bank balances change daily as a result of their business activities. Strong fluctuations in turnover are not uncommon in the market the group operates in. For these reasons, the group has opted for cash pooling with zero balancing at a bank that offers favorable conditions.

Due to low sales and excessive expenses, the current account of company A slides into debt of a million dollars. The other two companies, on the other hand, are financially stable and have collected credit balances of $700,000 and $800,000 respectively. By means of cash pooling, the bank balances of the three companies are consolidated every working day on a master account at the holding company’s bank. The resulting total balance is positive $500,000 and is used by company A to balance liquidity. The bank calculates the respective interest income and interest expenses on the basis of which the intra-group receivables and liabilities are settled: company B and C receive interest from company A. The financial resources therefore remain in the group and the need for external capital is eliminated.

Conclusion: financing model with stumbling blocks

Liquidity bundling offers obvious business advantages. All liquid capital is collected in one place, is centrally managed, and can be optimally distributed throughout the group so that it is less dependent on borrowed capital overall. However, you should always be aware of one thing when setting up this kind of system: Cash pooling is often a reason why the tax authorities may take a closer look. If you follow certain principles, however, you can minimize the risks and take advantage of the economic benefits of central liquidity management.

Click here for important legal disclaimers.