Keeping a cash book: The basics of cash book accounting

You should document the operating income and expenditures of your company well, not least because doing so helps to assess its success and financial state. At the end of the fiscal year, the IRS also needs a detailed final balance sheet for your company in order to determine the amount and type of your taxation. But how do daily account dealings look? To be able to document your cash payments in accordance with regulations, you need a cash book. But what exactly is that? And who is required to use cash book accounting? Here, we outline the most important fundamentals and explain how to correctly keep your cash book.

What is a proper cash book?

Many business owners now earn their money through cash-free payments (such as transfers, direct debits, credit card payments, etc.). But cash payment is still fairly common. To make sure that the IRS receives all of the information required for each transaction, you need to record your cash receipts. This is done using the cash book.

The cash book is one of the most important additional books for business accounting. You don’t even need to be an accountant to understand the fundamentals of proper cash book accounting. In general, you just need to focus on the following principle:

(1) Bookkeeping needs to be done so as to provide an expert third party with an overview of the transactions and financial situation of the company within a reasonable amount of time. The business transactions must be tracked during development and processing.

(2) Recordings need to be made in such a way as to fulfill the purpose for which they’re taxed.

Expressed simply: Accounting, including the cash book, serves as a tax base for companies. Because of this, each cash book entry (receipts, expenditures, document numbers, tax rates, etc.) needs to be understandable and comprehensible to the tax authorities.

There’s special software now that makes it much easier for you to keep your cash book. With this, you can run your cash journal efficiently, without wasting time or being troubled with bothersome computing work. But before you invest in a pricey software program, you should take the time to learn about its functions and specific features. In the case of online tools, data protection is particularly important in view of the financial data that’s being entered there.

Cash book accounting rules for record-keeping

To avoid issues when being audited, the IRS has a comprehensive list of recommendations for recordkeeping - when in doubt, just keep it all. Holding onto any and all supporting business documents will keep you from getting caught in the trap of unsubstantiated claims on your tax returns. It’s also recommended to keep all of your records neatly organized in chronological order based on the tax year and according to the type of income or expense. The following table provides an overview of the documentation recommended by the IRS:

| Type of record | Description | Included documentation |

| Gross receipts | All income received from business |

|

| Purchases | All items bought and resold to customers (including cost of materials or parts) | Canceled checks or other proof of transferred funds

|

| Expenses | Costs incurred for business |

|

| Travel, transportation, entertainment, and gift expenses | Deductible expenses |

|

| Assets | Property used for business |

|

| Employment taxes | Records of employment |

|

For proper cash book accounting, you should be sure to adhere to the Generally Accepted Accounting Principles (US GAAP). Failure to comply could result in sanctions, penalties, or, in the worst case, criminal charges.

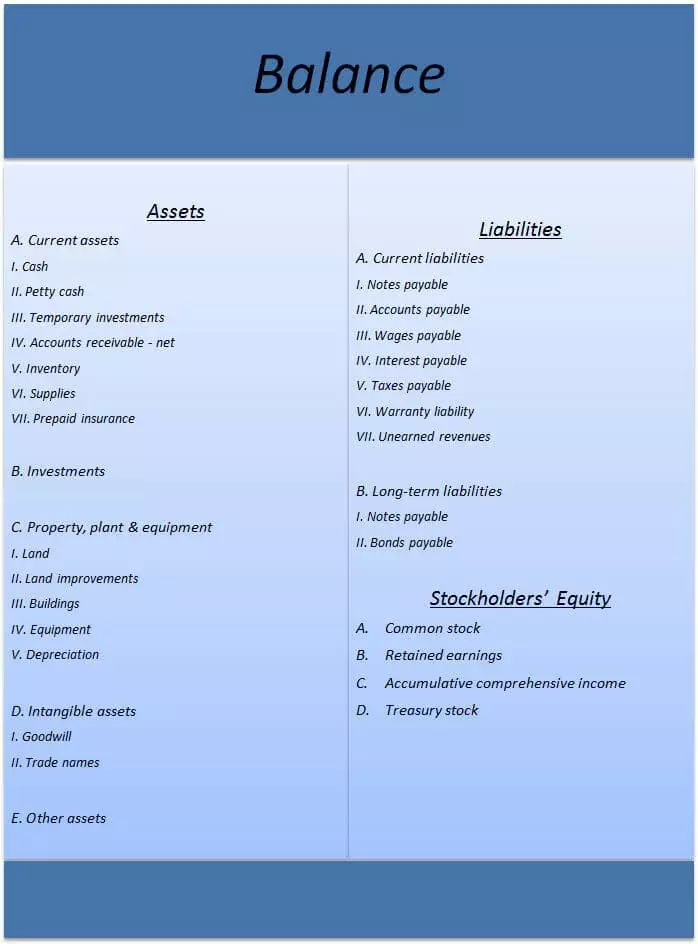

The cash book in the balance sheet

The cash book is an essential element of accounting. In the profit and loss statement, which must be submitted to the IRS at the end of the year, cash transactions also need to be included. To do this, enter the balance of the cash book as an assets item in the “Current Assets” section.

On LII you can find a full breakdown of all balance sheet requirements for the U.S. and which persons they apply to. For further information on balance sheets, refer to our article on the basics of double-entry accounting.

The following video will help you better understand the interplay between your cash drawer and the balance sheet:

To display this video, third-party cookies are required. You can access and change your cookie settings here.

To display this video, third-party cookies are required. You can access and change your cookie settings here. Source: https://www.youtube.com/watch?v=NkbCHQKxXXY

For whom is cash book accounting required?

Cash book accounting isn’t required of everyone. You only really need to keep a cash book if you operate using double-entry accounting, which is never legally required in the U.S. However, it is recommended for larger businesses.

If you run a small business, or simply choose not to use double-entry accounting and stick to simple accounting rules instead, you don’t necessarily need to keep a cash book. In this case, the IRS just needs a profit calculation in simplified form of cash-basis accounting.

A cash book can never have a negative value. This is because no cash register can contain less money than 0 dollars. If it does, then you’ve unfortunately miscounted and should review the calculation and revenue again

Even if you’re not required to keep a cash book, you should still consider it. For small and medium-sized businesses where cash is usually paid in exchange for services, cash book accounting offers one decisive advantage: An exact overview of the financial situation of your company.

How do I keep a cash journal?

At its core, cash book accounting is fairly simple: Everything that you take in or give out in cash needs to be entered into the cash book, chronologically and completely, and a profit calculation needs to be added up at the end. Once you understand the process, you’ll quickly develop your own routine. But before you start getting familiar, you should first know exactly how a cash book is built.

Structure of a cash book

To be able to neatly document your cash business, you need a consistently structured cash book. All entries need to contain the following information:

Date of the transaction

Receipt number for clearly assigning the document to the transaction

Booking text (short description of the transaction)

Receipt and currency of the cash revenue or expenditure

Applied tax rate (sales tax)

Current cash balance and debit balance

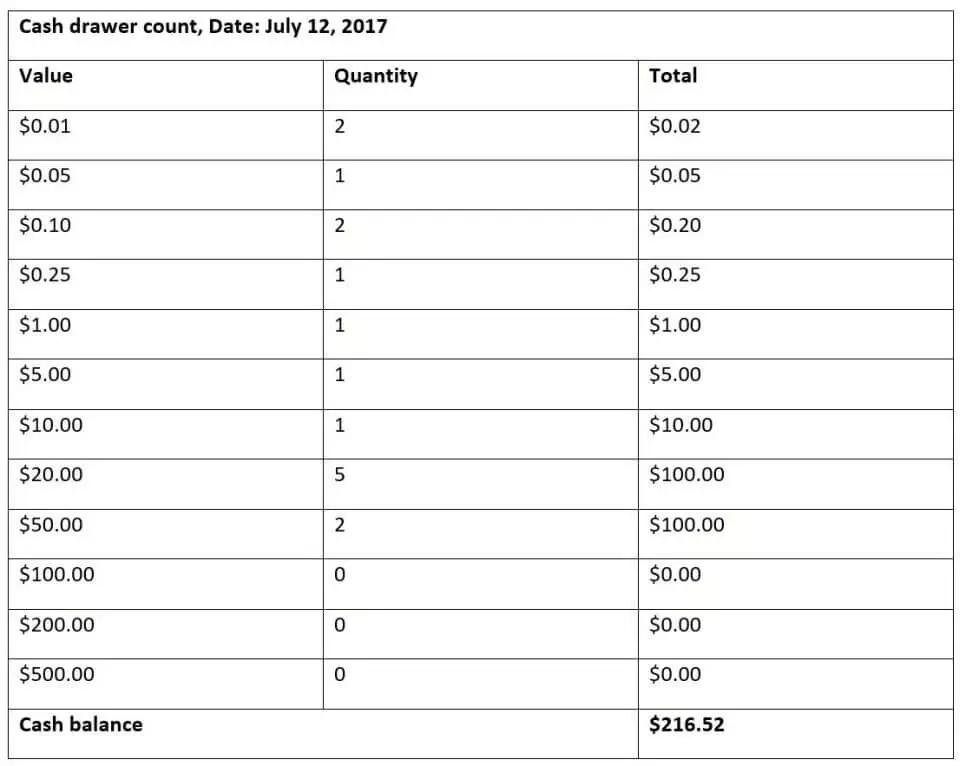

The current cash balance indicates the value of the actual cash count. This is determined with the help of the cash drawer count protocol. This simply means recording your own balance. List the contents of your cash drawer according to the value of the individual bills and coins, and then add the amounts. It’s important that in the end, the debit entries in your cash book correspond to the actual value of the cash count.

How cash book accounting works

With the right cash book template, you can start right away with your cash book accounting. Simply enter the required information into the corresponding fields, according to the instructions. Be sure to balance your cash journal every day, and carefully enter all of the data along with the relevant documents. When creating a cash book entry, note the following points:

The cash book may only contain cash transactions.

Enter the exact date as well as the opening balance of the previous day, month, or year.

Cash income goes in the “Revenue” column, and cash out goes in “Expenditure”.

Enter all cash transactions chronologically. Subsequent modifications are not allowed.

At the end, check whether the debit balance corresponds to the actual value of the cash count.

Make sure that your cash balance never displays less than 0 dollars.

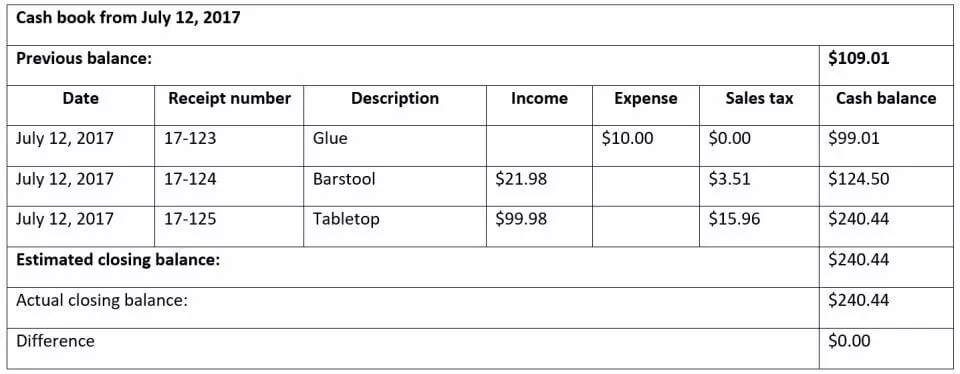

Example of a cash book

A cash book entry could look as follows:

Example of a cash drawer count

For a proper cash drawer count, you only need to enter the quantity of individual bills and coins in a list and then add together the entered values at the end:

Benefits of electronics cash book accounting

Thanks to professional software solutions, cash book accounting has become relatively simple. Entry into an electronic cash book means not only less effort but also more safety when it comes to the annual audit. Then, in the case that the IRS is unclear about something, you can quickly answer all of their questions without having to first go through your cash book. Above all, it’s important that your cash book meets all of the requirements of the tax office. It doesn’t so much matter whether you’re creating your cash book based on an Excel table or with the help of a professional finance software. Professional finance software allows you to keep your books in an efficient, time-saving, and accurate manner. It reliably stores all cash book entries and directly creates the corresponding documents. All of the documents required by the tax office are available for download. For example, if you operate an open checkout in your company, you can create a cash report with just a click and forward it directly to the tax office. At the same time, you always have an accurate overview of the financial situation of your company. In general, there are three different types of cash book accounting software:

| 1. Templates for Word and Excel | Benefits: Fast download; Simple operation - Drawbacks: Can be manipulated (and so rejected by the tax office) | Suitable for small, non-accountable businesses |

| 2. Online tools | Benefits: Accessible from all devices; No installation necessary - Drawbacks: Data security isn’t always sufficient | Suitable for small and medium-sized, accountable businesses |

| 1. Professional finance software | Benefits: High performance and reliable - Drawbacks: Installation necessary; potentially expensive | Suitable for medium-sized and large, accountable businesses |

Depending on how big your business is, whether it’s accountable or not, and how much your business operates with cash transactions, a special cash book software will make more or less sense for your business. For businesses or associations that aren’t accountable, cash books in the form of simple Excel spreadsheets are perfect, while large companies that do require bookkeeping benefit substantially from the many features of cash book software.

What risks do you run with faulty bookkeeping?

Errors in the cash book indicate improper financial accounting and aren’t accepted by the IRS. If there are violations that break the law or policy - i.e. due to missing information or subsequent changes - the IRS can react in the following ways:

- The submitted documents are returned to you with an invitation to correct the missing or incorrect information.

- The IRS shall make independent adjustments to penalties by means of partial or overall appraisals.

Depending on the range and severity of the violations, you could face the following penalties or criminal proceedings:

- Withdrawal of tax concessions (i.e. input tax)

- Unfavorable estimates of the tax basis

- Criminal prosecution for tax evasion

Please note the legal disclaimer relating to this article.