Digitalize or die: IONOS survey reveals challenges SMBs are facing in 2024

Technological change is affecting all industries. To remain future-proof and successful in the long term, SMBs must digitalize.

Phildelphia, March 26, 2024

IONOS, a leading digitalization partner for small and midsize businesses, today announced the results of its annual survey of 4,800 American (U.S.) and European small and midsize business (SMB) professionals regarding digitalization and cybersecurity resilience. American SMBs are prioritizing digitalization more than last year, but still trail European SMBs in almost all of the digitalization questions asked in the survey.

The data reveals that SMBs increasingly view digitalization as important for their future viability. More than three-quarters (79%) of American SMBs consider digitalization important for future viability in 2024, an increase of four percentage points over last year (2023: 75%). However, as was the case last year, American SMBs still trail their European SMB counterparts regarding the importance of digitalization for future viability: Spain (88%), Germany (82%), United Kingdom (81%) and France (80%).

“If you don’t put your business model on a digital footing now, you may soon no longer be on the market — especially as the AI revolution impressively demonstrates how essential it is to be open to new technologies and use them to your advantage. Our study shows that there is an awareness of the need for digitalization and a corresponding willingness to invest. As a strong digitalization partner and cloud provider, we help our customers to take advantage of the opportunities offered by digitalization and offer them secure solutions for every need,” said IONOS CEO Achim Weiss.

SMB digitalization investments and initiatives are increasing this year over last year

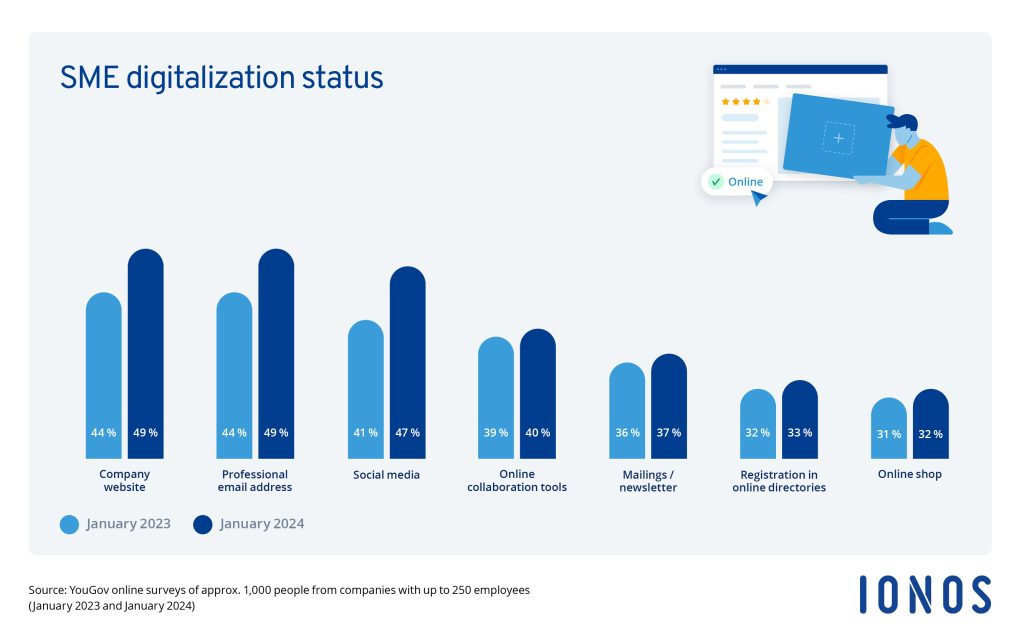

The increase in the importance of digitalization for American SMBs is reflected in the growth of their digitalization efforts this year. The top three areas of digitalization growth among American SMBs are website presence (2024: 49%; 2023: 44%), email domain usage (@companyname.com; 2024: 49%; 2023: 44%), and social media engagement (2024: 47%; 2023: 41%). Although the increases are significant this year, the percentage points are still lower for American SMBs than for European SMBs.

In addition to the above areas of growth in digitalization this year, American SMBs revealed their key areas of focus, reflecting their business goals for digitalization, which also grew in importance. The areas of focus include improving visibility of the company on the internet (2024: 46%; 2023: 41%) followed by IT security and data protection (2024: 43%; 2023: 38%). Still, as was the case last year, American SMBs trail their European SMB counterparts this year regarding improving visibility of the company on the internet (United Kingdom: 52%; Spain: 50%; Germany: 48%; France: 44%) and IT security and data protection (France: 51%; Germany: 46%; Spain: %44; United Kingdom: 43%).

American SMBs’ planned investments in digitalization this year echo the above areas of growth and focus. The top priorities for investment are their website (2024: 36%; 2023: 31%), social media (2024: 35%; 2023: 27%) and IT security and data protection (2024: 33%; 2023: 28%). The top priorities for SMB investments in digitalization across the European countries surveyed are the website for Spain (43%) and for the United Kingdom (37%); and IT security and data protection for Germany (34%) and for France (30%).

Along with an increase in the importance of digitalization this year, American SMBs more highly estimate its benefits. The three top-rated benefits of digitalization this year for American SMBs are winning new customers (2024: 75%; 2023: 72%), presence and ease of discovery on the internet (2024: 76%; 2023: 73%) and creating a modern image (2024: 76%; 2023: 71%). Almost all European SMBs in France, Germany, Spain and the United Kingdom ranked all three benefits higher than American SMBs.

Perceived barriers to digitalization are decreasing

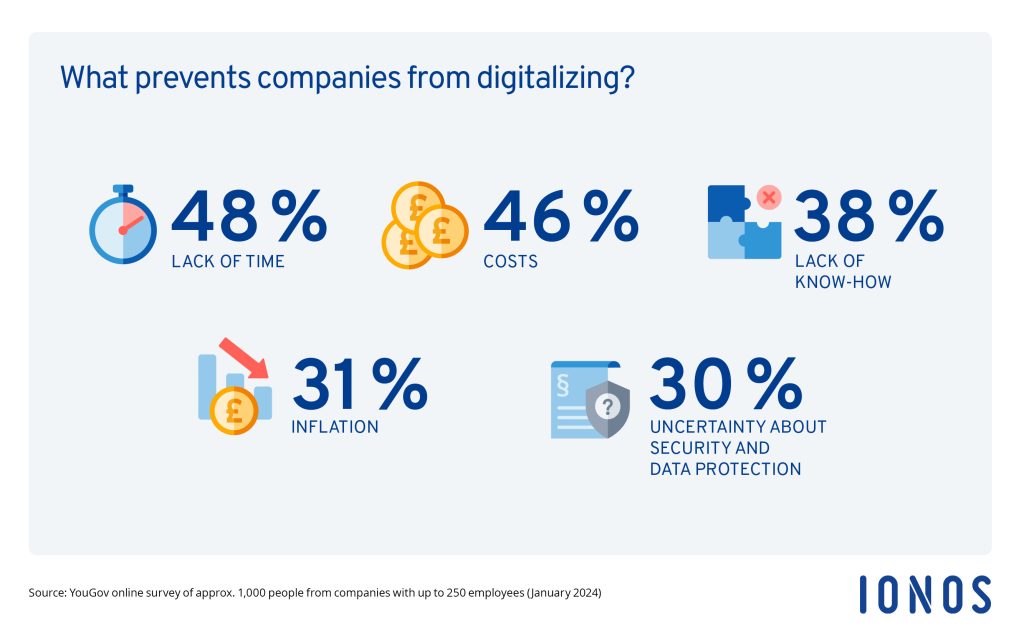

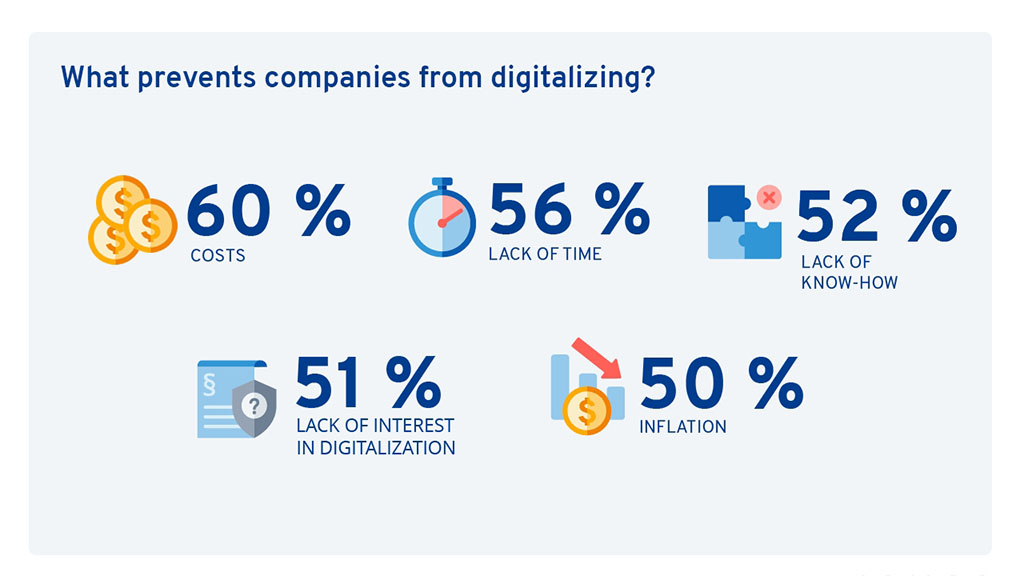

The survey revealed a considerable decline in the perceived major barriers to digitalization this year. This is possibly because the importance, investments and perceived benefits of digitalization all increased this year. The top three major barriers that American SMB respondents cite are costs (2024: 52%; 2023: 60%), inflation (2024: 50%; 2023: 50%) and lack of time (2024: 47%; 2023: 55%). Although their percentage points generally decreased, Spanish SMBs have the highest percentage points among European SMBs in their perception of major barriers to digitalization this year (costs: 68%; lack of time: 61%; lack of know-how: 61%).

Cybersecurity measures also increased this year to complement the overall increase in digitalization investments. The top three cybersecurity initiatives that American SMBs are implementing are regular updates and high password security (2024: 41%; 2023: 36%), choosing cloud and hosting solutions from providers experienced in cybersecurity and maintenance of critical infrastructure (2024: 36%; 2023: 33%) and multi-factor authentication (2024: 35%; 2023: 28%). The same cybersecurity initiatives are also the top three among European SMBs, and adoption leadership of the initiatives is mixed between American and European SMBs.

American SMBs lead in cloud and AI adoption to support digitalization

Digitalization and cloud adoption often go hand in hand, due to easier maintenance of cloud-based systems than on-premises systems and flexible cloud pricing based on usage. When asked what business processes their company already performs in the cloud, which is a new question this year, the top three cloud-based business processes that American SMBs report are storage, management and backup of documents and data (50%), website and databases (41%) and financial management (for example, accounting and key figure analysis, 38%). The same cloud-based business processes also are the most implemented among European SMBs this year, but the percentage points are mostly higher for American SMBs.

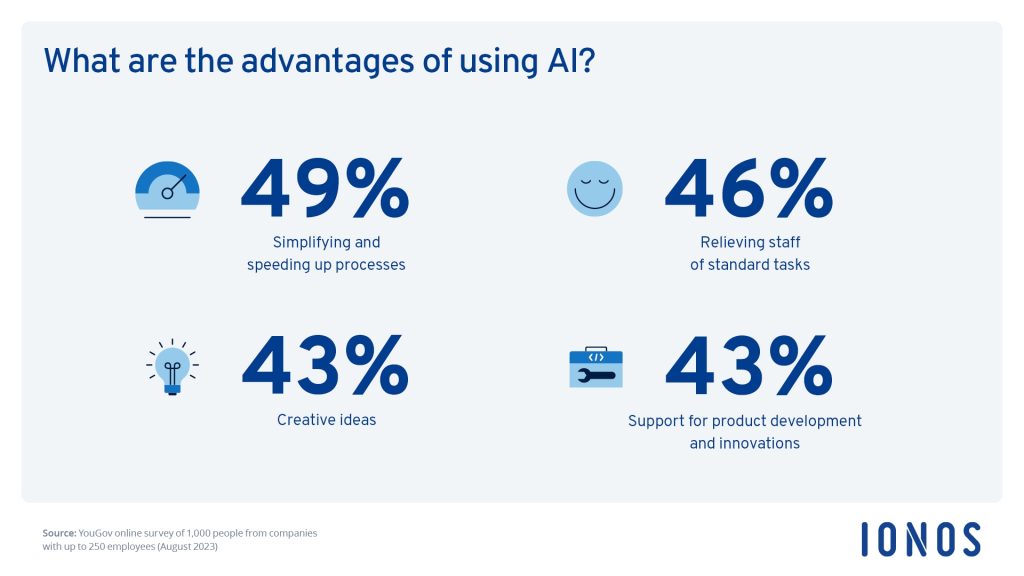

The last question related to digitalization in the survey is about the adoption of artificial intelligence (AI). It is a new question in this annual SMB survey, but was also included in an August 2023 survey of 1,000 Americans regarding AI for business use. When American SMBs were asked whether the use of AI tools, such as ChatGPT, is an option for their company, more than half (55%) say they are already using or willing to use AI, an increase of five percentage points over the August 2023 survey (50%). Answers to the same question by European SMBs indicate that AI adoption is currently lower among European SMBs than American SMBs.

Now is the time for SMB digitalization

The need for SMBs to prioritize digitalization in 2024 and beyond cannot be overstated. By embracing digital technologies, including artificial intelligence, and overcoming the barriers to digitalization, SMBs can unlock new opportunities for growth, innovation and competitiveness in an increasingly digitalized world. Now is the time for SMBs to seize the digital future and position themselves for success in the years ahead.

Although SMBs may face challenges in embracing digitalization and cloud strategies, they possess unique strengths and opportunities that can propel them toward success. By addressing resource limitations, tailoring solutions to their needs, prioritizing data security and compliance, and fostering collaboration and innovation, SMBs can effectively navigate the digitalization journey and emerge as agile, competitive and resilient players in the digital economy. With the right mindset and strategic approach, SMBs can unlock new growth opportunities and thrive in a digitalized world. SMBs require tailored solutions that align with their unique business requirements and objectives; this involves leveraging scalable and cost-effective cloud solutions that accommodate their specific needs and growth trajectories.

YouGov, an international research data and analytics group, conducted the survey of 4,800 respondents from American and European SMBs on behalf of IONOS in January 2024 (USA 1,001; UK 1,005; Germany 1,002; Spain 1,002; France 801 respondents).