Bitcoin –what you should know about the digital currency

For some time now online payment methods have established themselves as an alternative to money transfers, direct debit, and credit card payments. The likes of PayPal, Amazon Payments, Skrill, and more, have all begun to rival classic payment methods – in particular thanks to things like the speed of the transaction process and ease of international payments. Additionally, online payment services are subject to noticeably cheaper charges compared to those from banks, especially for smaller transactions. There are further advantages too, like buyer and seller protection, as well as account protection for credit cards, etc. One thing that these payment types have in common is that every transaction is processed through a central location, be it a bank or the online payment provider. Launched in 2009, the Bitcoin network is breaking with the basic concepts of conventional payment methods. This is happening through the distribution of the currency of the same name, as well as the transaction databank among all participating users, who are connected to the system via a client server. Thanks to this decentralized structure, Bitcoin is a currency system without an absolute authority. Though it still reserves the right to collect extensive user information which includes autonomously storing and managing all payment processing information. What – and who – is behind this digital currency which is increasingly gaining popularity as a payment method? And how and where can one actually pay with Bitcoin?

Who is behind Bitcoin?

On 1 November 2008, a mailing list discussing cryptography first proposed the idea of an electronic currency system with a network structure in which all participants are equal. This network would operate on a peer-to-peer basis. The post also contained a White Paper, which would then be released the following year and would serve as the basis of the open source software Bitcoin (today known as Bitcoin Core). Both the White Paper and the software were released under the pseudonym ‘Satoshi Nakamoto’, and to this day the true identity of this individual has not been revealed. The client software code has remained free all along and is visible and changeable to all. Many users have since helped to further develop Bitcoin.

Here’s how the Bitcoin system works

Anyone looking to become part of the currency network needs to install the already mentioned Bitcoin Core or one of the available alternatives, like Bither, Armory, or mSIGNA. These function as a so-called Bitcoin wallet; making it possible to send as well as receive Bitcoin, and to this end, also synchronize with the peer-to-peer network. To facilitate the first synchronization there needs to be sufficient bandwidth and storage space available, as the client server downloads files of a total size of more than 65 GB. Contained within these files is the communal public booking system, which forms the core of the Bitcoin network and is also referred to as a blockchain. It is in this chain, whose integrity and chronological order is safeguarded via cryptography, that all confirmed reservations are saved. The client server then calculates the status of a Bitcoin account based on this information. The security concept of the open source system is characterized not just by the encryption of its database, as each individual transaction is also assigned its own special protection in the form of a digital signature. This is generated automatically during the sending of Bitcoins via a classified data block – the private key (aka. the seed). Each user has their own private key, which can be found in the wallet. On the one hand, the signature acts as proof that the transaction being undertaken corresponds to the correct Bitcoin address. At the same time, it also ensures that the transaction, once it has been dispatched, can be modified or amended by other users. For a transaction to be confirmed and then disseminated amongst users, specific processes need to take place. These processes are also referred to under the general term mining. What happens during this handling process is that a transaction is signed, packaged into a block, and subsequently integrated into the blockchain. This is carried out with the help of special mining hardware and software, which has to be implemented to allow for the creation of a signature cryptographic hash functions (SHA256) and in principle, can be deployed by each participant. As a reward for this mining, the processor receives Bitcoins. At first glance, this might seem to be quite a lucrative reward. However, the hardware and operating costs are nearly on par with the income that can be gained from mining. This can be attributed to the large amount of competition in this area. More information on this topic, which is both interesting and fundamental to the Bitcoin network, can be found in this tutorial on weusecoins.com.

Where to buy bitcoins: here’s how to get your hands on them

Mining is the source for new Bitcoins and a possible way to buy and sell Bitcoins. Furthermore, it is possible to acquire currency by offering goods and services – and then allowing others to pay for these with Bitcoin. This then requires you to send your Bitcoin address to buyers. This can be done either by reverting back to the address that was automatically generated during the wallet’s installation, or alternatively by generating a new address code, as an abbreviation of the published key. The latter option is usually the most popular. This address can then be sent in the standard form or in the form of a QR code. Once the buyer has sent the payment, it should usually take no more than ten minutes until the digital coins are in your Bitcoin account

It’s also possible to buy Bitcoins, and here again there are two options available. LocalBitcoins.com is a Bitcoin trading website that operates on a person-to-person basis. It allows users across the world to find Bitcoin sellers near them and then pay for them in their local currency. Sellers can post advertisements, to which potential buyers can respond. Bitcoins can then be paid for in-person with cash or else via online bank transfer. LocalBitcoins.com prides itself on the fact that users deal with other human beings, and not just a centralized system. Users must sign up, but there is absolutely no charge for doing so.

Much more common is purchasing Bitcoins on special Bitcoin marketplaces like Bitcoin.com. Based on a regularly updated currency value, registered users can buy and sell Bitcoins. The website itself offers the option of buying Bitcoins with a credit card. Alternatively, it also offers a recommended list of current online exchanges and brokers, many of whom also offer the possibility of paying via bank transfer or even PayPal. Confirmation of a transaction usually take around ten minutes, but due to the growing popularity of the Bitcoin network, this time span has been known to increase, sometimes up to an hour. If it so happens that a transaction fails to confirm, then the system makes sure the transferred funds are sent back to the original sender’s wallet. Every web page of Bitcoin.com features a live tracker of the value of Bitcoin to the US Dollar in the top right-hand corner. The website also has a ‘News’ section displaying any recent articles relevant to the currency system, along with a user community forum as well.

Bitcoin: the pros and cons

To protect the electronic currency from the very real possibility of inflation, the system has a maximum of 21 million Bitcoins that can be in circulation at one time. Programming has ensured that this limit cannot be exceeded. According to the website blockchain.info, there are currently approximately 16.2 million Bitcoins in circulation (March 2017), meaning that there is still some way to go before the maximum limit is reached. On the one hand, this limit means that, through supply and demand, the Bitcoin market can regulate itself on a long-term basis. Up until now this has been the case. At the same time, it also means that the exchange rate of the currency is subject to heavy fluctuation; something which can quickly become a problem from the seller’s point of view. We have compiled a list of the advantages and disadvantages of Bitcoin:

The advantages of Bitcoin

- Inflation proof: As mentioned above, the Bitcoin maximum limit helps to ensure that the value of the digital currency is secured for the future. Once the maximum limit is reached, the production of new coins will not be possible. This is different compared to other currencies, where there is always the option of creating new coins, notes, etc.

- Payment freedom: In traditional currency systems, money and the state have always been closely linked. By contrast, Bitcoin is in no way restrained by countries – or even continents. This means that there is no complicated currency exchange necessary. By being a decentralized system, Bitcoin has given its users full control over the currency units, and is in no way subject to current economic limitations or to a payment increase due to geographical distance between the two parties involved.

- Lower costs: It doesn’t cost anything to open a Bitcoin account or to use the system. Anyone who wants to complete a transaction without the help of a sales processor, will only pay a fee if they want the transaction to happen quickly. In this case, a user can willingly pay extra for the network to confirm the transaction faster.

- Ease of use: There is no major effort involved in paying with Bitcoin. All that is really required is the target address of the trading partner, the respective amount to be transferred, and then send it off with one click. For this reason, it makes no real difference whether your wallet is on a desktop computer, on a smart phone, or in an online cloud. It is also irrelevant from what platform one commissions the transaction. Unlike other payment methods, both buyers and sellers are safe from hidden or unfair transaction fees.

- Protection for sellers: As a seller, you can not only profit from the low cost of sales involved with selling on the Bitcoin network. The system also offers significant advantages compared with more traditional payment methods. Thanks to the examination process by the participating computer systems, Bitcoin transactions are in fact irreversible. This means that it is impossible for the buyer to try and force a chargeback. This is a problem that particularly affects online shops in the beginning, when they are dealing with payment methods like invoices and bank transfers.

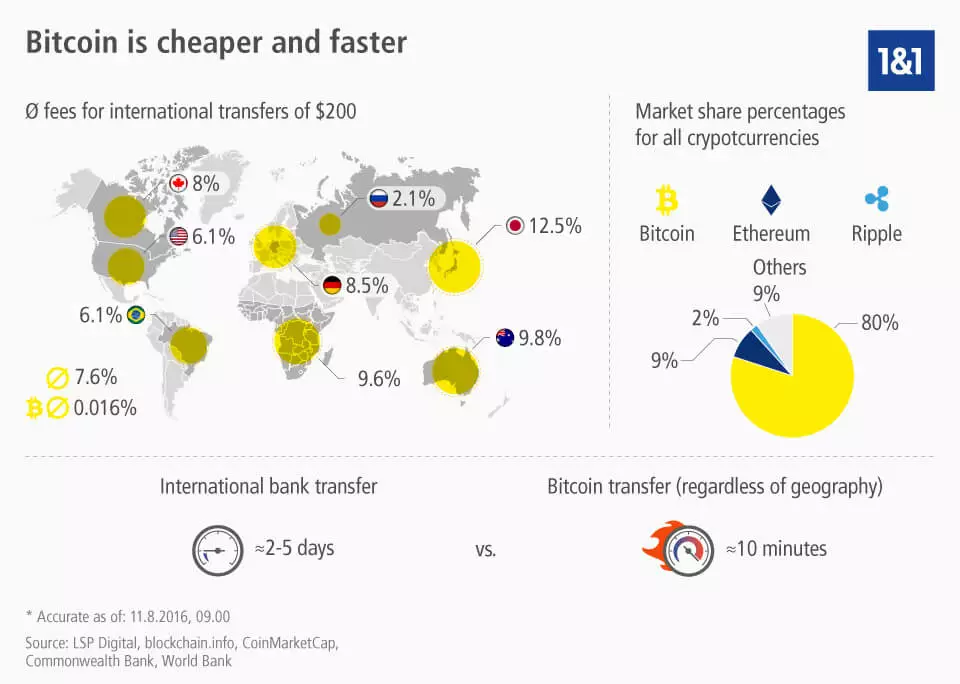

- Data protection: Traditional payment methods require you to disclose personal information to sellers and payment services – information which can then be passed on. Users of Bitcoin are not required to provide any information about themselves or their current address, and have the advantage of there being no central database of information collecting statistics on buyer behavior. This is quite different to a bank or similar service providers like PayPal, who accumulate and amass extensive and detailed information on transactions that have been made. On top of this, the security and integrity of transaction information is granted by the blockchain. If needed, users can additionally protect their wallets through backups and encryption. The financial advantages when it comes to transferring Bitcoin, compared to more traditional currencies, are well summed up in the following infographic:

Here you can download the infographic on Bitcoin transfer costs.

Disadvantages of Bitcoin

- Smaller circulation: Even if it is the case that digital payment methods like PayPal and Amazon Payments have generally established themselves in the E-Commerce sector, then the Bitcoin system still occupies quite a niche role. There is a lack of both retailers as well as potential customers who have a Bitcoin account and use the digital currency as a method of payment. In order for users to get the most out of what the network has to offer, and to establish a long-term and stable value through Bitcoin, then a growth in the number of clients is necessary.

- Complicated legal situation: Although not being illegal in any country, decisions and regulations about the use of Bitcoin lies with the legal system of each individual country. In Vietnam for example, the digital currency can only be used privately and the use of it by financial institutions is prohibited. Due to these imposed rulings, it often so happens that Bitcoin exchanges adjust their service for specific countries. The complicated starting point has made it difficult not just to cooperate with banks, for instance when it comes to something like exchanging coins, but also regularly leads to sudden slumps in the market.

- No Plan B for the loss of a key: The decentralized structure only then becomes a problem if you happen to lose your wallet. Wallets are not saved in the Bitcoin network, i.e. in the blockchain, and therefore are not recoverable. It is also impossible to access the coins that have been lost, meaning that all that currency can no longer be used for transactions.

- Deflation danger: As the number of potential new Bitcoins steadily decreases, at the same time the demand for them increases – and with that so does the price. The natural decrease in coins, which occurs as a result of the loss of personal wallet keys and the coins contained within. This encourages investors to buy Bitcoins, keep them for a long time, and speculate about higher market rates.

- Highly fluctuating value: The small number of individuals, retailers, and companies involved are the deciding factor for the highly fluctuating Bitcoin market price. Even minor events, activities, or transactions can have a big influence on the price, and up until now, this has made the market very unpredictable. For this reason, entering into the market on a business level is accompanied by risk.

- Continuous development process: If the statements of the developers involved are to be believed, then the Bitcoin software is still in the Beta phase. New and unfinished functions, tools, and services are relatively common, and the network wishes to make these more widely and securely available. It regularly happens that various minor programming errors occur, but thanks to the engaged and very vigilant community, these are always fixed quickly.

Offering Bitcoin as a method of payment – here’s how it works

To allow customers to pay with Bitcoins in your online shop, you will first need a wallet, which can be acquired through installation of the software. Once the digital coin collection has been installed, you have two possibilities for obtaining coins from customers:

- Through the use of an external dealer service like BitPay or Coinbase, which function as a link between you and your customers. In some cases, these providers will also offer to convert the Bitcoins into another currency. The fees charged for these services are specific to the individual vendors.

- Or you impart the address of your Bitcoin account yourself and then check yourself that the customer then transfers the agreed amount to the account. While this does save the expense of an external dealer, it does require a lot of effort and coordination. The money that is saved from not paying for the external processing of the transactions can then be spent in other areas of your business.

If you decide to opt for the latter option, you should create an individual Bitcoin address for each transaction, to avoid complications later when assigning and organizing payments. This will allow you to assign invoices to the corresponding address. To help with this, there is also a separate information page, where you can list the Bitcoin addresses that correspond to the individual account numbers. This list can then be copied by the buyer and pasted into the client server. In addition, it is also your responsibility to determine the Bitcoin price for the goods and/or services on offer. Usually it makes sense to use current exchange rates as the basis for coming up with these prices. But it is also recommended that you include an extra clause in the sales contract, which allows for a price adjustment if there is a large fluctuation in the market price of Bitcoin. This should then clearly outline who will pay for the transaction fees (usually the buyer). The receipt of a payment can then be reviewed and verified in your own wallet or on blockexplorer.com. Given that Bitcoin does not have an integrated buyer protection system, the option of an escrow service might be worth offering, especially for larger transactions.

Using Bitcoins – what does the future hold?

The fundamental principle behind every currency is the assurance that there is someone else that wants to have it. It doesn’t matter if it is paper money, gold bars, or digital coins. The deciding factor for the future of Bitcoin is a more widespread acceptance.

There are two major factors that can be seen as being behind the general reluctance of many potential Bitcoin users: a lack of trust in the security, and the inconsistency of the payment network. Established exchange platforms have in the recent past often fallen victim to cyber-attacks, wherein several million dollars’ worth of coins have been stolen. These attacks are just one of the reasons for the fluctuations in the value of the digital currency. Additionally, the low level of circulation, uncertain legal situation, and the not yet complete development process are all reasons for hesitation in embracing this currency.

The Bitcoin software itself can certainly be seen as secure. Any changes to the underlying protocol can only be made with the agreement of all users. On top of that, the steady growth of available coins should in the long term have a calming effect on the price and also prevent extreme fluctuations in the future. Anyone who decides to add the option of this aspiring payment method to their online shop is only really taking a risk if, overnight, a huge part of their total turnover is suddenly transformed into Bitcoin form. With smaller, individual transactions, Bitcoin may mean an additional expense, but at the same time, also the opportunity to access a whole new customer base.